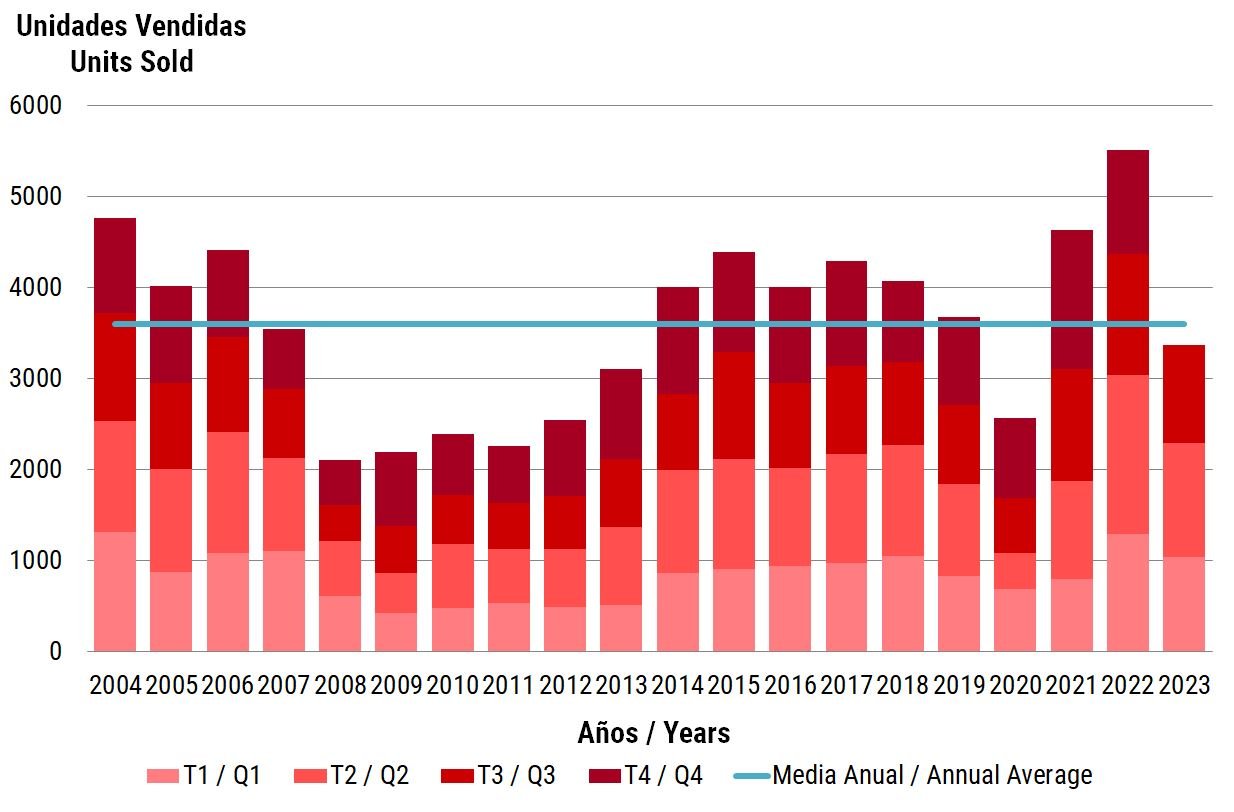

As we have gone through the first quarter of 2024 and observed activity on the market, the data on closed transactions for the fourth quarter of 2023, and thus for the entire year, has been released. From this information, we can draw a couple of conclusions that align with recent trends:

1. 2023 proved to be a solid year for the real estate market, although it didn't surpass the historic performance of 2022. Despite experiencing a notable -18.0% decrease in Marbella and a more modest -5.1% decline in Benahavis in the number of annual closed transactions compared to 2022, it's important to note that 2023 still brought positive outcomes for both municipalities. These percentage declines may seem substantial, but they are in comparison to 2022, a year that set historic records for closed transactions in the whole area.

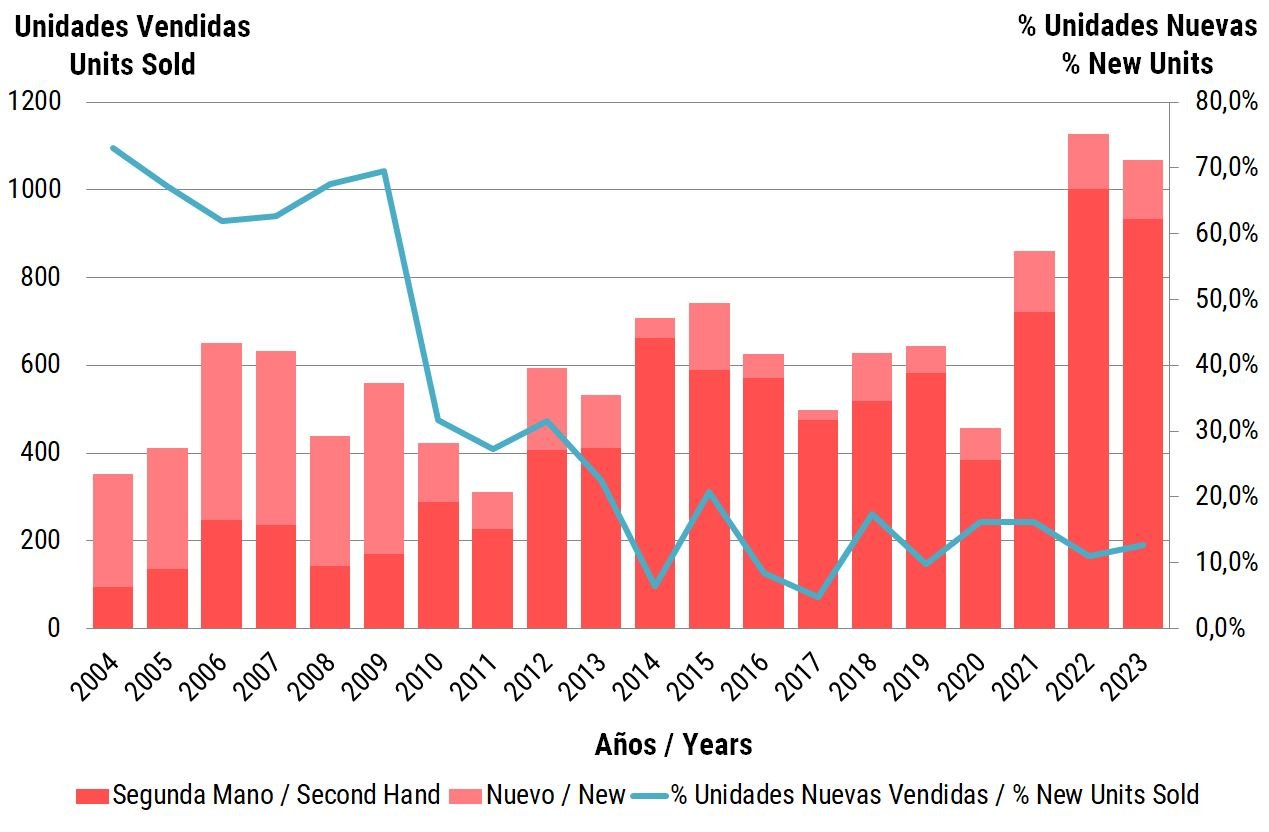

2. The proportion of new unit sales has remained relatively stable. Despite fluctuations, as illustrated in the chart, the average number of new unit sales as a percentage of total sales has hovered around 7.3% for Marbella and 13.3% for Benahavis over the past decade.

These figures are significantly lower than the peaks of 45% and 65% seen during the pre-2008 crisis boom. In fact, the oversupply of new constructions played a role in that crisis, with about five times more construction activity compared to now, yet only approximately 50% of newly built units were being sold. The current numbers indicate the maturity of the market, more controlled development activity, increased developer experience, and a scarcity of available land compared to the abundance seen in 2001.

In summary, the real estate market in the Costa del Sol area continues to demonstrate resilience and positive performance, buoyed by promising macroeconomic conditions and ongoing investments. However, we have to acknowledge the geopolitical uncertainties that have arisen in the first quarter of 2024, presenting a potential risk to stability.