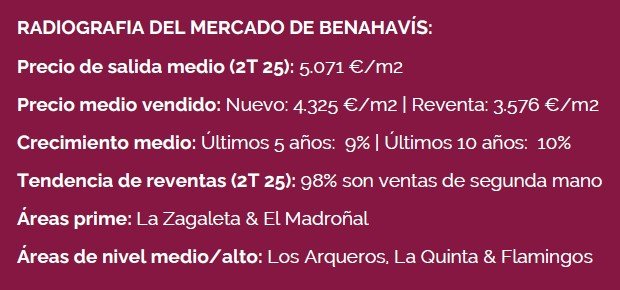

Benahavís, the jewel in the hills of the Costa del Sol and part of the Golden Triangle with Marbella and Estepona, combines prestige with the highest income per capita in Andalusia. Yet behind its reputation lies a more nuanced reality regarding resale value and liquidity.

1. Supply: Scarcity as a Safeguard. Limited new development continues to support prices. Strict planning rules and a shortage of available land - especially for apartments concentrated in Real de La Quinta - keep supply tight. In past cycles, new builds made up 70 % of sales; during the last five years they averaged 10 %, reaching a record low of only 2 % in 2025.

2. Cooling Signs: The Gap Between Asking and Achieved Prices. In Benahavís, price data often reflects asking rather than actual sale values, creating false expectations among sellers. Over the past twelve months, the average gap reached 31.4%, while transactions fell around 20% in Q2 compared with the same quarter of 2024 - usually the most active of the year. The figures reveal growing market caution, where achieving premium prices requires realistic valuation and top presentation standards.

3. Liquidity: Patience Required. Prime properties may achieve 7,000–9,000 €/m², yet finding the right buyer can take time. The luxury and ultra-luxury markets rely on a smaller, more selective pool. For mid-high-end homes, realistic pricing is essential to avoid long market exposure.

4. What Protects Resale Value

Location: sea views, south orientation, or proximity to golf.

Condition: renovated, modernized homes sell faster and closer to asking.

Exclusivity: gated privacy remains a premium.

Market Positioning: villas 1.5 – 4 M€ and 250 - 750 k€ apartments attract steady demand.

5. Takeaways for Buyers and Sellers

Buyers: resale homes offer immediate availability; scarcity of new builds supports long-term security.

Sellers: premium pricing applies only to properties in excellent condition— overpricing risks extended exposure and weaker negotiation power.

In summary, Benahavís remains one of the Costa del Sol’s most secure investment markets. Scarcity, global demand, and lifestyle appeal sustain values—but success depends on realistic price expectations and quality.

Article by

Alfonso Lacruz