THE HIDDEN COSTS OF LUXURV LIVING IN BENAHAVIS : TAXES, EXPENSES AND LIFESTYLE

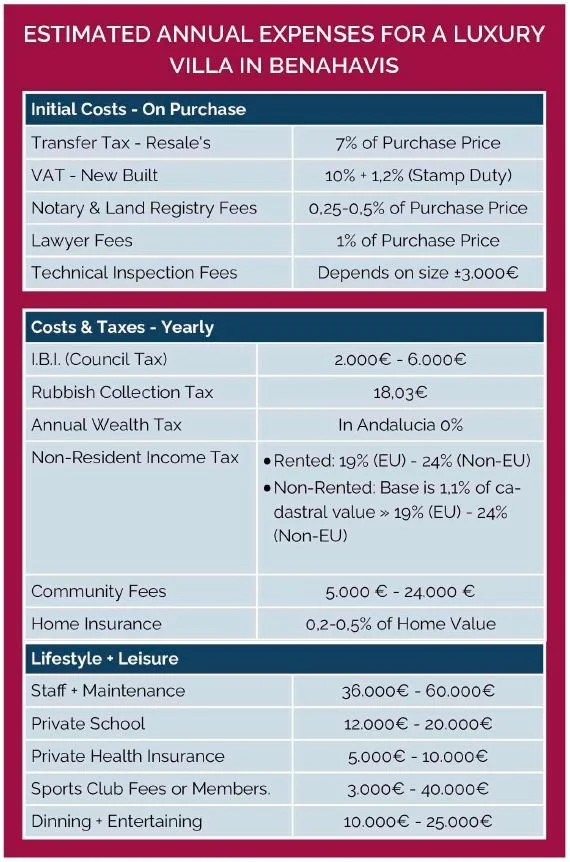

Purchasing a luxury villa in Benahavís is not just a real estate decision - it's about entering a lifestyle defined by privacy, security, and comfort. However, the true cost of ownership goes well beyond the listing price.

1. Initial Costs - On Purchase: In addition to the property price, buyers must factor in taxes (Transfer Tax for resales. or VAT and Stamp Duty for new builds). Notary and Land Registry fees, legal services and technical inspections. These costs typically range between 10- 12% of the purchase price. Keep in mind that rates may vary depending on the municipality and type of property.

2. Annual Costs & Property Taxes: Once the property is yours. ongoing expenses such as council tax (IBI), rubbish collection, community fees and home insurance become part of your annual budget. For nonresidents. income tax and wealth tax obligations may also apply, especially for properties not used as a primary residence.

"The true cost of ownership is more than square meters - it's how you live within them."

3. Lifestyle & Leisure: Families relocating full - or part-time to Benahavís should also plan for international school tuition, private health insurance, golf or sports club memberships, and regular dining or entertaining. These expenses enhance quality of life - but should be budgeted realistically from the start.

Note: The costs shown in the table are estimates for guidance only. Figures vary depending on lifestyle, residence status, property type and community services such as security or amenities. Taxes must be calculated individually.

For a tailored breakdown. contact our team to help you plan wisely and invest with confidence.

LA BRECHA DE PRECIOS ESTÁ FRENANDO EL RITMO DEL MERCADO INMOBILIARIO DE LA COSTA DEL SOL

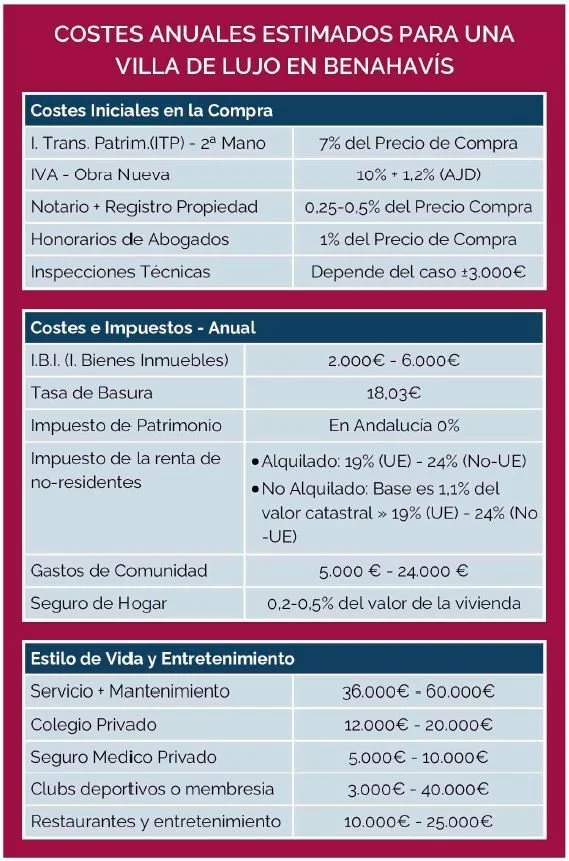

Aunque la solidez estructural del mercado en la Costa del Sol se mantiene, el escenario actual muestra que las expectativas de los vendedores se alejan cada vez más de la realidad del comprador. Los datos más recientes confirman que los compradores serios y bien informados siguen activos, pero son cada vez más selectivos. Esto ha ampliado la llamada "brecha de negociación", el espacio entre el precio que se pide por las viviendas y el precio final de cierre, que hoy es el principal factor que afecta a la liquidez y la velocidad de venta en el segmento de lujo.

1. Una brecha excesiva entre expectativa y valor real: la diferencia entre el precio de salida y el precio de cierre (del Registro de la Propiedad) se ha convertido en el mayor freno del mercado. Las cifras son contundentes: en Benahavís, la brecha alcanza ya el 36%, lo que supone 1.341 €/m² de diferencia. Marbella le sigue con un 31% (1.239 €/m²), y Estepona con un 28%. Este desfase refleja que muchas propiedades salen al mercado con precios que los compradores simplemente no están dispuestos a aceptar.

2. Fricción y un ritmo de ventas más lento: este aumento del desfase ha provocado una clara desaceleración. En el segundo trimestre de 2025. las compraventas en Marbella, Benahavís y Mijas cayeron alrededor de un 20% respecto al año anterior. Solo en Marbella, el número de operaciones bajó un 20.9% frente al segundo trimestre de 2024. Las viviendas sobrevaloradas permanecen más tiempo en el mercado, generan desconfianza y frenan el ritmo general.

3. La solución: coherencia en el precio para proteger el valor. Para revertir esta tendencia, los vendedores deben apostar por la realidad del mercado desde el inicio. Un precio coherente atrae compradores serios, acorta los plazos y evita reducciones posteriores. En resumen, la demanda sigue siendo sólida y las perspectivas a largo plazo continúan siendo positivas, pero el éxito hoy depende de una estrategia de precio realista у alineada con el mercado, саpaz de cerrar con éxito la creciente brecha de negociación.

VIVIR EN BENAHAVIS: EL VERDADERO COSTE DEL LUJO. IMPUESTOS, GASTOS Y ESTILO DE VIDA

Comprar una villa de lujo en Benahavís no es una decisión meramente inmobiliaria: es entrar de lleno en un estilo de vida definido por la privacidad, la seguridad y el confort. Sin embargo, el verdadero coste de la vivienda va mucho más allá del precio de compra.

1. Costes iniciales - En La compra. Además del precio de la propiedad, los compradores deben tener en cuenta los impuestos (Transmisiones Patrimoniales para reventas, o IVA y Actos Jurídicos Documentados en obra nueva), los honorarios de Notaría y Registro, los gastos de abogados y las inspecciones técnicas.

En conjunto, suelen representar entre 10% y el 12% del precio de compra. Conviene recordar que los importes pueden variar entre según el municipio y el tipo de propiedad.

2. Costes anuales e impuestos. Una vez adquirida la vivienda, entran en juego gastos recurrentes como el IBI. la tasa de basura, las cuotas de comunidad y el seguro de hogar. En el caso de no residentes, también se aplican el impuesto sobre la renta y el impuesto sobre el patrimonio, especialmente si la propiedad no se utiliza como residencia habitual.

3. Estilo de vida y entretenimiento. Las familias que se trasladan total o parcialmente a Benahavís deben contemplar también gastos como colegios internacionales, seguros médicos privados, membresías en clubes de golf o deportivos, y cenas o actividades de ocio. Estos costes elevan la calidad de vida, pero conviene presupuestarlos desde el principio.

Nota: Los importes indicados en la tabla son estimaciones orientativas. Las cifras pueden variar según el estilo de vida, la condición fiscal del propietario, el tipo de vivienda y los servicios disponibles en la comunidad, como seguridad o servicios. Los impuestos deben calcularse individualmente.

Contacte con nuestro equipo y le ayudaremos a planificar e invertir con confianza.

BRIDGING THE NEGOTIATION GAP: HOW PRICING SHAPES TODAY'S COSTA DEL SOL MARKET

While long-term value remains exceptionally strong on the Costa del Sol. the market has reached a stage where seller expectations are drifting from buyer reality. Our latest data confirms that serious, informed buyers are still active but increasingly selective. This shift has widened the "Negotiation Gap," the space between the advertised asking price and the final closing price, now the key factor affecting liquidity and sales speed in the luxury segment.

1. The Excessive Gap: Expectations vs Market Value. The divergence between the Asking Price and the Closed Price (Land Registry) is the main reason transactions are slowing. The figures are striking: in Benahavis, the negotiation gap stands at 36%, equivalent to €1,341 per square meter, Marbella follows at 31% (€1,239/m2) and Estepona at 28%. These differences clearly show that many homes enter the market with asking prices buyers simply reject.

2. Market Friction and a Slower Sales Pace. This widening gap has led to a noticeable slowdown. Closed transactions in Marbella, Benahavís, and Mijas dropped by around 20% in Q2 2025 compared with the previous year. Marbella alone saw a 20.9% decline in units sold versus Q2 2024. Overpriced listings remain longer on the market. eroding buyer confidence and reducing overall momentum. The result is a cycle of inefficiency that slows the entire market.

3. The Solution: Price Coherence Protects Value. To reverse this trend, sellers must embrace realistic pricing from the start. Overpricing weakens negotiating power and often leads to harder final discounts. By contrast. properties priced in line with real demand attract serious buyers quickly and close closer to their asking value. A coherent valuation is not just a recommendation - it's a vital strategy to ensure a swift, secure sale and protect your capital.

In summary, demand remains robust and long-term fundamentals are strong, but achieving success today requires strategic, marketcoherent pricing that bridges the growing negotiation gap.

THE TRUTH ABOUT RESALE VALUE IN BENAHAVÍS: PRESTIGE VS. MARKET REALITY

Benahavís, the jewel in the hills of the Costa del Sol and part of the Golden Triangle with Marbella and Estepona, combines prestige with the highest income per capita in Andalusia. Yet behind its reputation lies a more nuanced reality regarding resale value and liquidity.

1. Supply: Scarcity as a Safeguard. Limited new development continues to support prices. Strict planning rules and a shortage of available land - especially for apartments concentrated in Real de La Quinta - keep supply tight. In past cycles, new builds made up 70 % of sales; during the last five years they averaged 10 %, reaching a record low of only 2 % in 2025.

2. Cooling Signs: The Gap Between Asking and Achieved Prices. In Benahavís, price data often reflects asking rather than actual sale values, creating false expectations among sellers. Over the past twelve months, the average gap reached 31.4%, while transactions fell around 20% in Q2 compared with the same quarter of 2024 - usually the most active of the year. The figures reveal growing market caution, where achieving premium prices requires realistic valuation and top presentation standards.

3. Liquidity: Patience Required. Prime properties may achieve 7,000–9,000 €/m², yet finding the right buyer can take time. The luxury and ultra-luxury markets rely on a smaller, more selective pool. For mid-high-end homes, realistic pricing is essential to avoid long market exposure.

4. What Protects Resale Value

Location: sea views, south orientation, or proximity to golf.

Condition: renovated, modernized homes sell faster and closer to asking.

Exclusivity: gated privacy remains a premium.

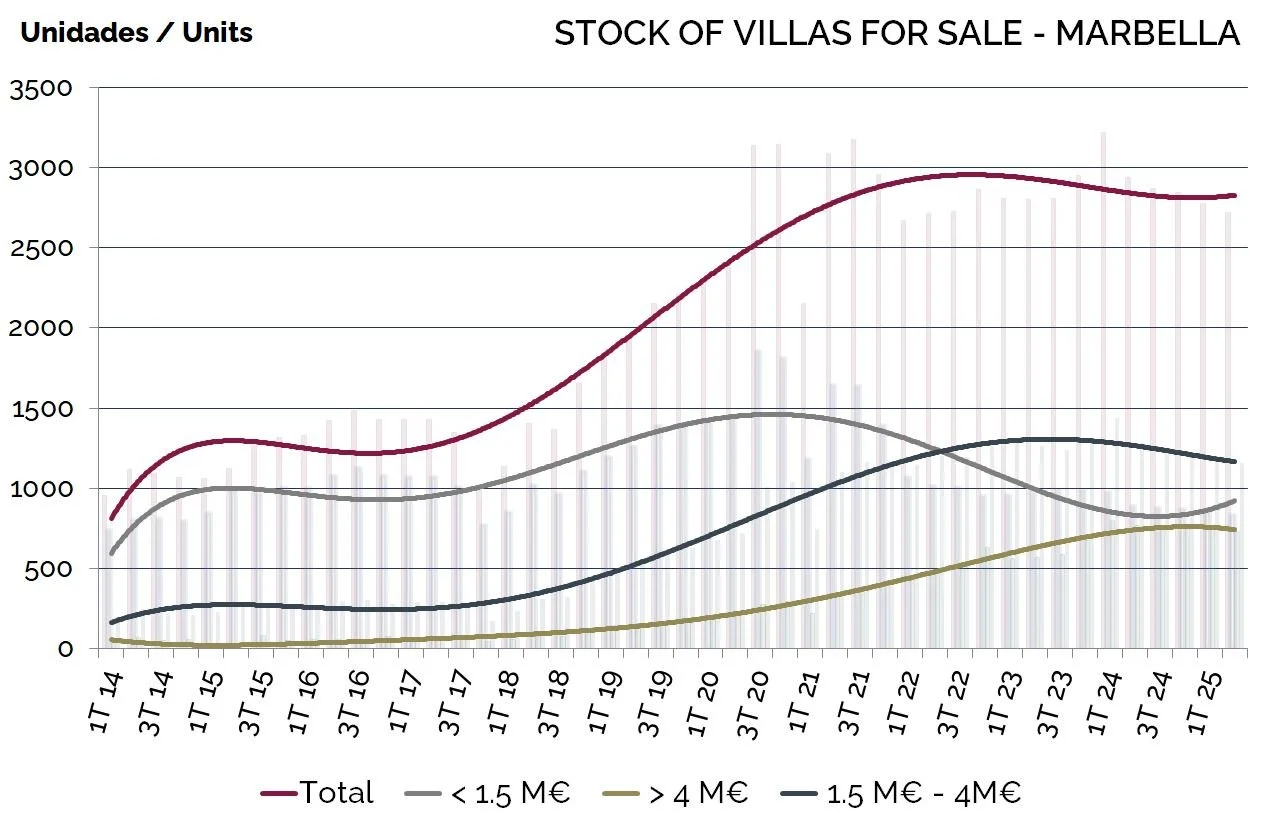

Market Positioning: villas 1.5 – 4 M€ and 250 - 750 k€ apartments attract steady demand.

5. Takeaways for Buyers and Sellers

Buyers: resale homes offer immediate availability; scarcity of new builds supports long-term security.

Sellers: premium pricing applies only to properties in excellent condition— overpricing risks extended exposure and weaker negotiation power.

In summary, Benahavís remains one of the Costa del Sol’s most secure investment markets. Scarcity, global demand, and lifestyle appeal sustain values—but success depends on realistic price expectations and quality.

Article by

Alfonso Lacruz

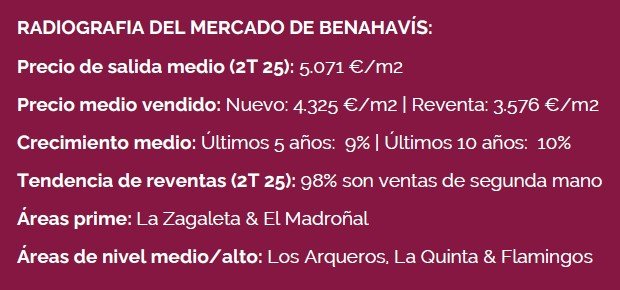

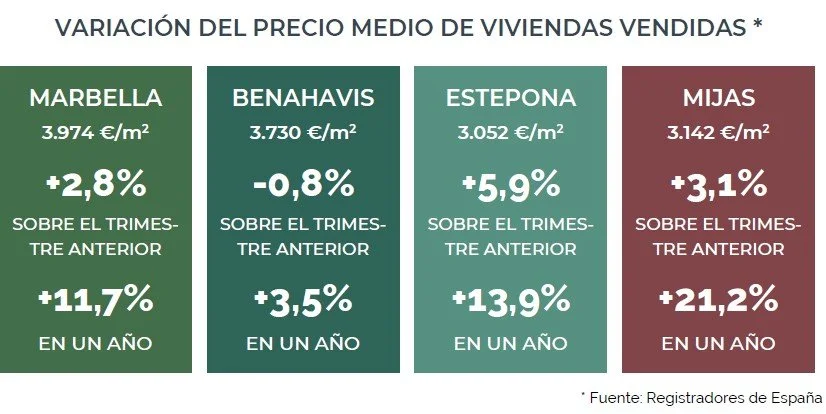

COSTA DEL SOL REAL ESTATE MARKET Q2 2025: FEWER SALES, STABLE PRICES

The latest Land Registry data for the western Costa del Sol pre-sents a market that remains funda-mentally healthy but has clearly shifted in pace. Prices continue to trend upward, yet transaction vol-umes have dropped noticeably com-pared with the same period last year. After two exceptional years of strong activity, this moderation suggests the market is returning to a more sus-tainable rhythm rather than entering a downturn. Serious buyers are still active, but they are increasingly se-lective and value-driven, focusing on properties that combine quality, loca-tion, and realistic pricing.

1. Sales volumes have fallen sharply, but prices remain resilient. Closed transactions decreased by around 20% in Marbella, Benahavís, and Mijas during Q2, while Estepona was the only area to post a modest gain of +3.6%. Despite these declines, prices have continued to rise across most municipalities. This resilience highlights the strength of the local market, sup-ported by limited supply of modern homes and con-sistent demand from both domestic and international buyers.

2. Price trends di-verge across areas. Marbella and Estepona recorded quarterly price gains of +2.8% and +5.9%, while Mijas led the region with an impres-sive +21.2% annual increase. Bena-havís was the only market to show a small quarterly de-crease (–0.8%), suggesting a temporary pause after several years of growth, particu-larly in the high-end segment where buyer caution is more evident.

3. The gap between asking and sell-ing prices continues to widen. Since mid-2024, asking prices have risen faster than achieved sale prices, reflecting a growing disconnect be-tween seller expectations and buyer sentiment. While this may lead to longer marketing times, well-priced listings continue to attract strong interest, confirming that confidence in the Costa del Sol remains solid and long-term fundamentals are intact.

For homeowners, this means:

Well-priced homes will stand out this autumn, as buyers grow more selective and mo-tivated — making now the ideal moment to attract seri-ous offers before year-end.

Article by

Alfonso Lacruz

LA VERDAD SOBRE EL VALOR DE REVENTA EN BENAHAVÍS: PRESTIGIO FRENTE A REALIDAD DEL MERCADO

Benahavís, la joya de la Costa del Sol y parte del Triángu-lo de Oro junto a Marbella y Estepona, combina presti-gio, exclusividad y la renta per cápita más alta de Andalucía. Su reputación como destino residencial de lujo está consoli-dada, pero conviene analizar la realidad del mercado en cuanto a valor de reventa y liquidez.

1. Oferta: la escasez es la defensa del valor. La falta de obra nueva sigue sosteniendo los precios. El urbanismo y la escasez de suelo - especialmente para apartamentos, don-de prácticamente solo queda suelo en Real de La Quinta - limitan la oferta. En el ciclo de 2008 la obra nueva represen-taba el 70 % de las ventas; en los últimos cinco años apenas el 10 %, alcanzando un mínimo del 2 % en 2025.

2. Señales de enfriamiento: la brecha entre precio de ofer-ta y cierre. Los datos publicados de precios reflejan a me-nudo expectativas, no valores reales, generando falsas es-peranzas entre los vendedores. En los últimos doce meses, la diferencia media entre precio de salida y cierre fue del 31,4%, mientras las ventas bajaron un 20% en el segundo trimestre respecto a 2024, tradicionalmente el más activo. El mercado exige mayor realismo: alcanzar precios premium requiere un valor ajustado y una presentación impecable.

3. Liquidez: paciencia y estrategia. Las propiedades de alta gama alcanzan entre 7.000 y 9.000 €/m², pero pueden tar-dar en venderse por el reducido grupo de compradores potenciales. En el rango medio-alto, ajustar el precio al mer-cado evita que una venta se alargue y pérdida de atractivo.

4. Factores que protegen el valor de reventa:

Ubicación: vistas abiertas al mar, orientación sur o cerca-nía a campos de golf.

Estado: viviendas renovadas o modernizadas se venden antes y más cerca del precio de salida.

Exclusividad: la privacidad en comunidades cerradas si-gue siendo un valor premium.

Posicionamiento: villas entre 1,5 y 4 M€ y apartamentos entre 250 y 750 k€ mantienen demanda constante.

5. Claves para compradores y vendedores:

Compradores: la falta de obra nueva re-fuerza el valor a largo plazo de las reventas.

Vendedores: los precios premium solo se logran con propiedades en excelente estado; precios caros implican más tiempo en el mercado y menor capacidad de negociación.

En resumen, Benahavís sigue siendo uno de los mercados más sólidos y seguros de la Costa del Sol. La escasez, la demanda y su estilo de vida sostienen los valores, aunque el éxito depende cada vez más de la realidad del precio, la calidad y la estrategia de venta

Artículo de

Alfonso Lacruz

MERCADO INMOBILIARIO DE LA COSTA DEL SOL: BAJAN LAS VENTAS, LOS PRECIOS SE MANTIENEN ESTABLES

Los últimos datos del Registro de la Propiedad reflejan un mercado que sigue mostrando solidez, aunque

con un ritmo más lento. Los precios continúan al alza, pero el número de compraventas ha caído de forma notable respecto al mismo periodo del año anterior. Tras dos ejercicios de gran actividad, esta moderación parece más un ajuste natural que una corrección. Los compradores siguen activos, aunque cada vez son más selectivos y valoran la calidad, la ubicación y, sobre todo, un precio coherente con el mercado actual.

1. Las ventas caen con fuerza, pero los precios se mantienen firmes. Durante el segundo trimestre, las

operaciones cerradas descendieron alrededor de un 20% en Marbella, Benahavís y Mijas, mientras que Estepona fue la única zona en registrar un leve incremento (+3,6%). A pesar de ello, los precios medios siguen mostrando una evolución positiva en la mayoría de municipios, lo que evidencia que la demanda

para viviendas bien presentadas y situadas en buenas ubicaciones continúa siendo sólida y estable.

2. Evolución desigual según la zona. Marbella y Estepona registraron aumentos trimestrales del +2,8% y +5,9%, respectivamente, mientras que Mijas lideró el crecimiento anual con un notable +21,2%. Benahavís

fue la excepción, con un ligero descenso (–0,8%) que apunta más a una pausa técnica tras varios años de fuerte apreciación, sobretodo en el segmento de lujo, donde el comprador se muestra más analítico y paciente.

3. Aumenta la brecha entre precio de oferta y precio de cierre. Desde mediados de 2024, los precios de

salida han crecido más rápido que los precios finales de venta, reflejando una mayor cautela entre los compradores y una cierta rigidez entre los vendedores. Aun así, las viviendas correctamente valoradas siguen atrayendo interés real, confirmando que la confianza en la Costa del Sol se mantiene firme y con fundamentos sólidos a largo plazo

Para propietarios, significa: Las viviendas con un precio realista de mercado destacarán este otoño, cuando los compradores son más selectivos pero decididos, siendo un tiempo ideal para vender.

Artículo de

Alfonso Lacruz

STOCK DE VIVIENDA EN MARBELLA & BENAHAVIS: DOS TENDENCIAS OPUESTAS

Al comenzar el último trimestre del año, el mercado inmobiliario de Marbella refleja dos realidades opuestas: escasez en villas y mayor oferta en apartamentos. Benahavís presenta un comportamiento similar, aunque Marbella muestra la visión más clara del conjunto.

1. Villas: Escasez de Oferta.

El inventario de villas ha bajado un –7,4% interanual, confirmando la limitada disponibilidad. La mayor caída se da en el rango de 1,5–4M€, en descenso desde 2022.

Por encima de 4M€, la oferta se mantiene estable, mientras que las villas más baratas, por debajo de 1,5M€, han bajado debido a la fuerte demanda y la falta de nuevas construcciones.

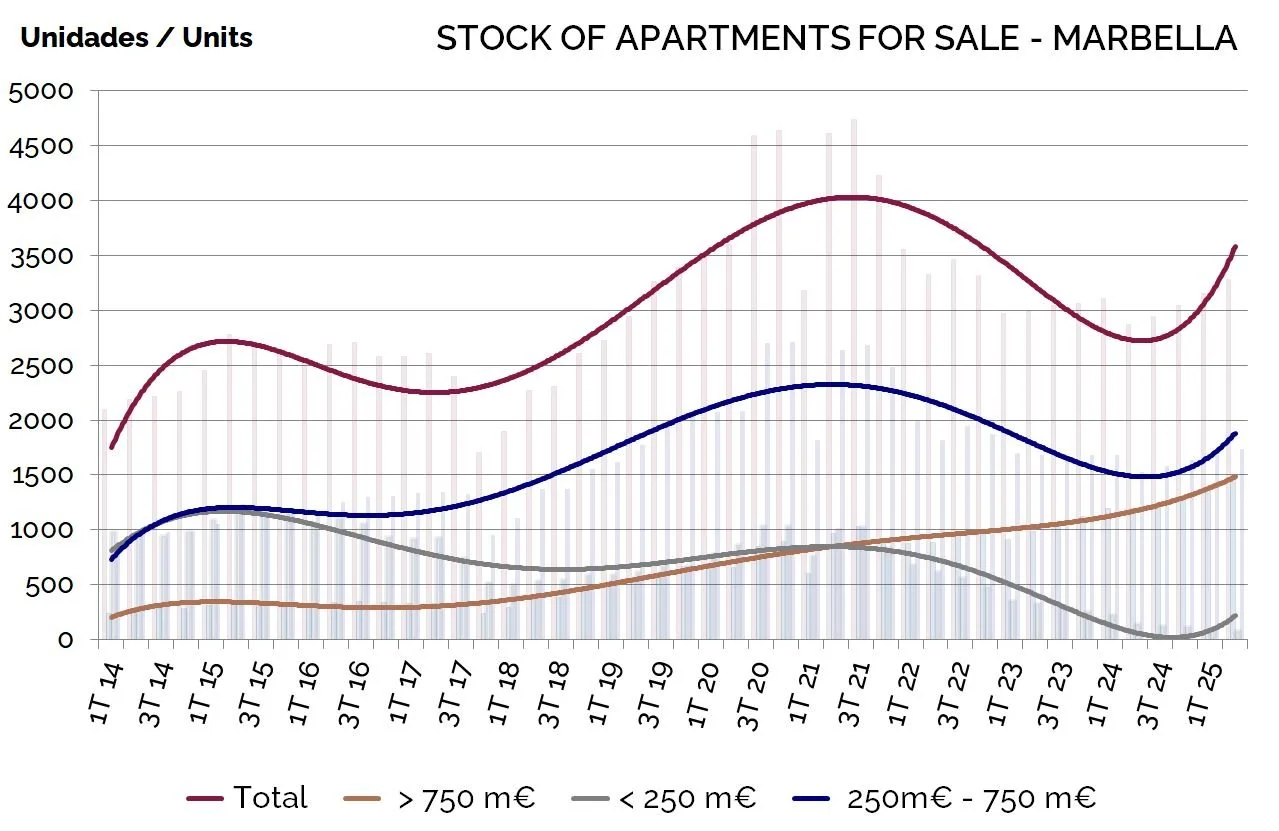

2. Apartamentos: Aumento del Inventario.

En contraste, los apartamentos han aumentado un +14,5% respecto al año pasado. El mayor crecimiento corresponde al rango 250–750K, que sigue siendo el más activo para compradores nacionales e internacionales. También destaca la gama alta, a partir de 750K, impulsada por proyectos modernos y compras asociadas al estilo de vida. En el nivel bajo, por debajo de 250K, la oferta sigue a la baja, confirmando la falta de opciones asequibles.

3. Polarización. El mercado se polariza

Villas cada vez más limitadas frente a un parque de apartamentos en expansión. La demanda sigue firme,

adaptándose a la oferta disponible en cada segmento.

Para propietarios, significa:

Villas: se benefician de la menor competencia, sobre todo en el rango 1,5M€–4M€.

Apartamentos: más competencia, pero las viviendas bien presentadas y con precio correcto siguen atrayendo compradores.

Compradores: las oportunidades en rangos bajos desaparecen, mientras aumenta la oferta en segmentos medios y altos.

Articulo de

Alfonso Lacruz

MARBELLA & BENAHAVIS MARKET INSIGHT: SUPPLY GAPS ACROSS PRICE RANGES

As we head into the last quarter of the year, Marbella’s real estate market reveals two contrasting stories: villas remain scarce, while apartments show increasing availability. Benahavís follows a similar trend, but Marbella offers the clearest picture.

1. Villas: Declining Supply

Villa stock is down –7.4% year over year, reinforcing scarcity in the detached home segment. The steepest drop is in the 1.5–4M€ range, where supply has tightened since 2022. At the very top, above 4M€, inventory has stabilized, while entry-level villas under 1.5M€ are now limited due to strong demand and minimal new builds.

2. Apartments: Rising Inventory.

In contrast, apartment stock has risen +14.5% compared with last year. Growth is strongest in the 250–750K€ segment, which remains highly active among both national and international buyers. High-end apartments above 750K€ are also expanding, supported by lifestyle demand and modern developments. At the same time, affordable options under 250K€ continue to shrink, reflecting how rare budget-friendly properties have become.

3. Diverging Dynamics.

The overall picture is one of polarization: scarcity in villas versus growing availability in apartments. Rather than a slowdown, demand is adjusting to value and supply across different price brackets.

For homeowners, this means:

· Villa sellers continue to benefit from limited competition, especially if positioned in the 1.5M€–4M€ range.

· Apartment owners will face more competition, but correctly priced and well-presented properties still attract significant buyer interest.

· Buyers should be aware that opportunities in the lower brackets are disappearing, while choice is increasing in mid-to-high-end apartments

ARTICLE BY ALFONSO LACRUZ Malaga´s New Build Market 2024: Why demand is outrunning supply

The latest figures from the Ministry of Housing for 2024 confirm a trend I’ve been highlighting for the past two years: while demand for newly built homes remains strong across the province of Malaga, construction is still lagging behindintensifying pressure on supply and prices. Let’s look at what the data shows and why this matters for buyers, investors, and homeowners.

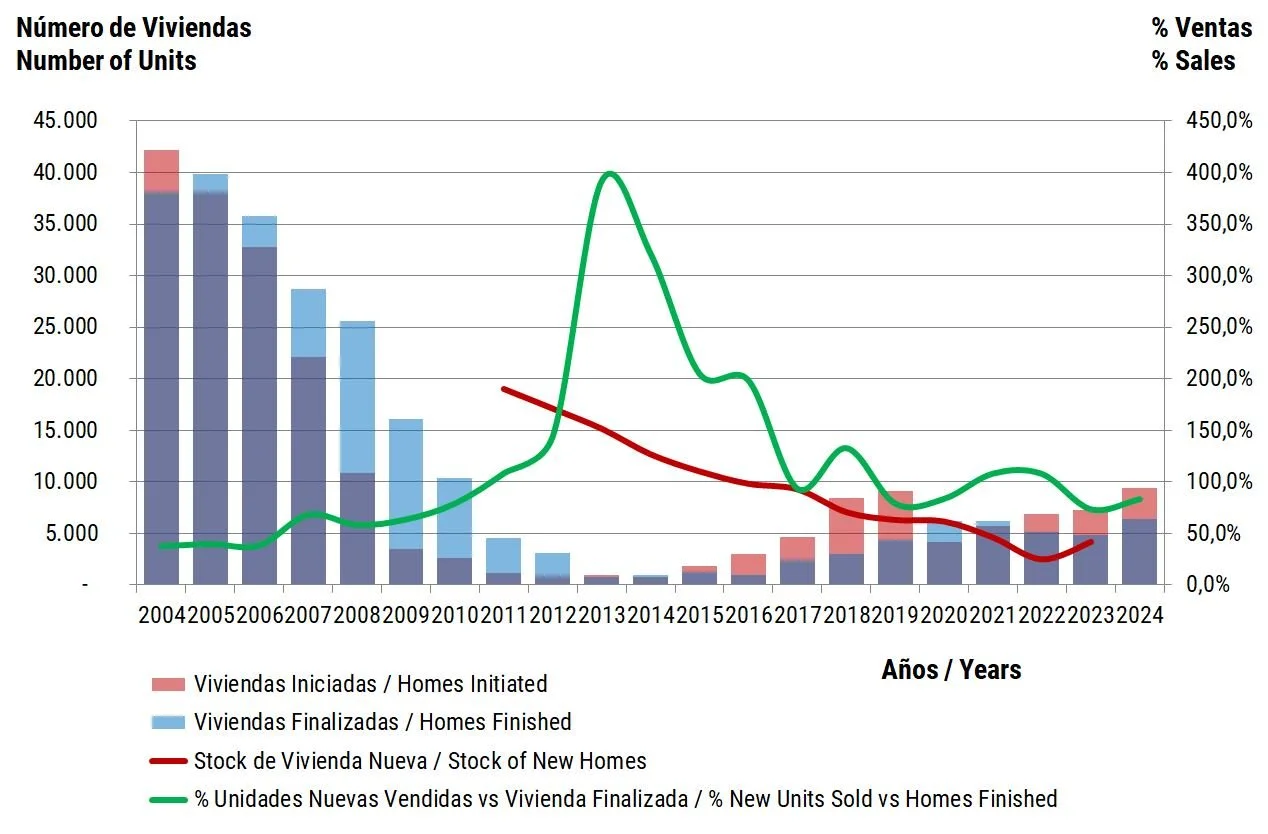

1. Stock of New Homes Remains Historically Low: The red line in the chart represents the stock of newly built homes available on the market. After peaking during the 2008 crisis, that stock has steadily decreased. In 2024, the stock remains well below pre-crisis levels, despite a moderate recovery in construction activity. This is a key difference compared to the 2004–2007 bubble years, when oversupply became a systemic risk.

2. Construction Has Not Returned to Boom Levels: The number of homes being completed (blue bars) and initiated (red bars) in 2024 is still a fraction of the peak seen in 2005. Back then, over 40,000 units were finished in one year, and even 83.000 in 2003. In contrast, 2024 barely reaches a quarter of that. Developers today are more cautious, and financing is stricter—good news for market stability, but a bottleneck for supply.

GRÁFICO 1 - OBRA NUEVA TERMINADA FRENTE A VENDIDA – MALAGA

“We are in a market deïfned by low inventory, contro-lled construction, and sustained demand."

3. Sales Continue to Outpace Deliveries: The green line in the chart—showing the % of new units sold vs. units finished—remains close to or above 100% in recent years. This means more homes are being sold than delivered, reducing available inventory. This dynamic fuels competition for high-quality properties, especially in prime areas like Marbella and Benahavís.

4. Price Pressure is Inevitable: With demand exceeding supply, prices for new builds continue to rise. As highlighted in my June 2024 newsletter, new developments in Marbella have seen average annual price increases of 17.9% over the past three years. This contrasts with second-hand properties, which have grown at 9.2% per year. Investors seeking capital appreciation and lifestyle buyers prioritizing quality are driving this upward trend.

In summary, we’re not witnessing a 2008-style bubble—far from it. Instead, we are in a market defined by low inventory, controlled construction, and sustained demand. For those considering a purchase or investment, especially in sought-after areas like Marbella and Bena-havis, understanding these trends is crucial. The best opportunities are being snapped up quickly and at increasingly higher prices.

Article by:

Alfonso Lacruz

El Mercado de la Obra Nueva en Málaga en 2024: La demanda supera la oferta

Las últimas cifras del Ministerio de Transportes para 2024 confirman una tendencia que vengo señalando en los últimos dos años: aunque la demanda de viviendas de obra nueva sigue siendo muy fuerte en la provincia de Málaga, la construcción sigue sin alcanzar el ritmo necesario, lo que aumenta la presión sobre la oferta y los precios. Veamos qué nos dicen los datos y por qué esto es relevante para compradores, inversores y propietarios.

1. El stock de viviendas nuevas sigue en mínimos históricos: La línea roja del gráfico representa el stock de viviendas de obra nueva disponibles en el mercado. Tras el máximo alcanzado durante la crisis de 2008, ese stock ha disminuido de forma constante. En 2024, se mantiene muy por debajo de los niveles previos a la crisis, a pesar de una recuperación moderada de la actividad constructora. Esta es una diferencia clave respecto a los años de burbuja 2004–2007, cuando el exceso de oferta se convirtió en un riesgo sistémico.

2. La construcción no ha vuelto a los niveles del boom: El número de viviendas terminadas (barras azules) e iniciadas (barras rojas) en 2024 sigue siendo solo una fracción del máximo alcanzado en 2005. Entonces, se terminaron más de 40.000 unidades en un solo año. En contraste, en 2024 apenas llegamos a una cuarta parte de esa cifra. Los promotores hoy son más prudentes y la financiación es más estricta, algo positivo para la estabilidad del mercado, pero un cuello de botella para la oferta.

GRÁFICO 1 - OBRA NUEVA TERMINADA FRENTE A VENDIDA – MALAGA

“Se trata de un mercado definido por baja oferta, construcción controlada y demanda sostenida.”

3. Las ventas siguen superando a las entregas: La línea verde del gráfico, que muestra el % de viviendas nuevas vendidas frente a las terminadas, sigue cerca o por encima del 100% en los últimos años. Esto significa que se venden más viviendas de las que se entregan, reduciendo el inventario disponible. Esta dinámica genera competencia por las propiedades de calidad, especialmente en zonas prime como Marbella y Benahavís.

4. La presión sobre los precios es inevitable: Con una demanda que supera a la oferta, los precios de la obra nueva siguen en aumento. Como destacaba en mi newsletter de junio de 2024, las nuevas promociones en Marbella han registrado incrementos medios anuales del 17,9% en los últimos tres años. En comparación, las viviendas de segunda mano han subido un 9,2% anual. Los inversores que buscan plusvalía y los compradores que priorizan calidad están impul-sando esta tendencia al alza.

En resumen, no estamos ante una burbuja como la de 2008, ni mucho menos. Se trata de un mercado definido por baja oferta, construcción controlada y demanda sostenida. Para quienes estén pensando en comprar o invertir, especialmente en zonas tan demandadas como Marbella y Benahavís, comprender estas tendencias es clave. Las mejores oportunidades se ven-den rápido… y cada vez a precios más altos.

Artículo de:

Alfonso Lacruz

Marbella & Benahavis Real Estate in 2025: Strong Foundations

With 25 years in the luxury real estate market of Marbella and Benahavis, I constantly analyze our dynamic land-scape based on the numbers of real estate. Latest data through early 2025 confïrms the market's resilience, showing Marbella's strong demand and Benahavis undergoing a healthy adjustment after peak growth. This continuous evolution highlights our region's enduring appeal and robust fundamentals. In delving into the specificscs, several relevant points emerge that paint a clearer picture of our current market.

1. Marbella's Enduring Strength: Marbella consistently performs above its long-term average. Despite some sales volume shifts in Q2 2024, Marbella has shown remarkable resilience. Q1 2025 started very strong, surpassing Q1 2024. This consistent performance, often exceeding prepandemic averages, indicates a stable and attractive market, a primary destination for buyers seeking high-quality lifestyles and solid investments.

2. Benahavis, Adjustment and Future Growth: After significant surges in 2021-2022, Benahavis is in an adjustment period. While 2023 and early 2024 saw reduced sales from peak highs, this is a healthy correction, not a downturn. 2024's total sales were above the 20-year aver-age, reflecting underlying strength. Benahavis offers exclu-sivity and larger plots, with this recalibration creating new opportunities. Q1 2025 shows renewed buyer interest, particularly for high-quality new builds.

"Marbella and Benahavis real estate markets conti-nue to demonstrate dynamism and resilience."

3. Navigating Market Nuances: Our market is balanced between supply and demand, with strong international buyer interest. While some segments saw reduced activity due to less inventory or higher pricing, the market as a whole progresses. Increased new-build availability offers more buyer options. Price stability, with increases in Marbella, reflects market health. Potential interest rate reductions could further stimulate demand, emphasizing the need for data-driven insights.

In summary, Marbella and Benahavis continue to demonstrate dynamism and resilience. While Benahavis adjusts post-peak, Marbella sustains its upward trajectory with strong demand and stable prices. The positive start to 2025, especially in Marbella, underscores our region's enduring appeal for luxury real estate. As an experienced agent and despite a personal feeling, as we do not have any data yet, that the market is cooling down in this sec-ond quarter of 2025, I remain confident in this vibrant market's long-term strength, driven by its unique lifestyle and sustained international buyer confidence.

Article by:

Alfonso Lacruz

El Mercado Inmobiliario en Marbella y Benahavís en el inicio de 2025: Solidez

Tras 25 años analizando la dinámica del sector inmobilia-rio de lujo de Marbella y Benahavís a través de sus datos, los últimos gráficos basados en los números de ventas cerradas en el primer trimestre de 2025 confirman la resiliencia de nuestro mercado: Marbella muestra una deman-da sólida y Benahavís atraviesa un ajuste, que se puede considerar saludable, tras un periodo de crecimiento excepcional. Esta evolución constante subraya el atractivo y la robustez de base de nuestra zona. Al adentrarnos en los detalles, emergen varios puntos clave que dan una visión más clara del panorama actual.

1. Marbella: Una Fortaleza Constante: Marbella mantiene un rendimiento consistentemente superior a su promedio histórico a largo plazo. A pesar de ciertas variaciones en el volumen de ventas durante el segundo trimestre de 2024, la capacidad de resiliencia de Marbella ha sido notable. El primer trimestre de 2025 ha arrancado de nuevo con fuerza, superando incluso las cifras del primer trimestre de 2024. Este comportamiento, a menudo por encima de los niveles prepandemia, consolida a Marbella como un mercado estable y sumamente atractivo, siendo un destino principal para compradores que buscan tanto calidad de vida como una inversión segura.

2. Benahavís: Ajuste y Nuevo Crecimiento: Tras los significativos repuntes de 2021-2022, Benahavís se encuentra en una fase de ajuste. Aunque 2023 y principios de 2024 mostraron una moderación en las ventas respecto a sus picos, es fundamental entenderlo como una corrección necesaria y saludable, no como un declive. De hecho, las ventas totales de 2024 estan por encima del promedio de los últimos 20 años, lo que refleja una fortaleza intrínseca. El primer trimestre de 2025 ya muestra un renovado interés de los compradores, especialmente por las propiedades de obra nueva de alta calidad.

“Tanto Marbella como Benahavís continúan demostrando un dinamismo y una resiliencia dignas de mención”

3. Claves para Navegar el Mercado: Nuestro mercado se caracteriza por un equilibrio entre la oferta y la demanda, con un fuerte interés por parte de inversores internacionales. Si bien algunos segmentos pudieron experimentar una menor actividad debido a la escasez de inventario o a precios demasiado elevados, el mercado en su conjunto sigue avanzando. La estabilidad de los precios, con incrementos en Marbella, es un claro indicador de la salud del mercado. Además, la posibilidad de futuras reducciones en los tipos de interés podría dinamizar aún más la demanda, subrayando la importancia de tomar decisiones basadas en datos sólidos.

En resumen, tanto Marbella como Benahavís continúan demostrando un dinamismo y una resiliencia dignas de mención. Mientras Benahavís consolida su posición tras un periodo de auge, Marbella mantiene su trayectoria ascendente con una demanda robusta y precios estables. El inicio positivo de 2025, especialmente en Marbella, ratifica el atractivo duradero de nuestra región para la inversión inmobiliaria de lujo. Con muchos años de experiencia en este mercado y a pesar de una sensación de enfriamiento en el segundo trimestre de 2025 del cual todavía no se disponen de datos, mi confianza en la solidez a largo plazo de este mercado es plena, impulsada por su singular estilo de vida y la constante confianza de los compradores internacionales.

Article by:

Alfonso Lacruz

¿Cómo se ha comportado el Mercado de Lujo durante 2024 en Marbella y Benahavís?

El mercado inmobiliario de lujo en Marbella y Benahavís continúa su actividad en 2024, mostrando cambios evi-dentes en precios y comportamiento de los compradores. Entender estas variaciones es esencial para ser cap az de analizar el mercado en el panorama actual de alto nivel.

1. Marbella: Crecimiento Generalizado en Todos los Ni-veles de Precios. El mercado de Marbella ha registrado una fuerte actividad transaccional en todos los rangos de precio en 2024, superando en algunos casos los niveles récord de 2022. Las propiedades entre 1.5M€ y 4M€ si-guen siendo las más activas en unidades vendidas, de-mostrando una resiliencia constante. Destaca el aumento en las ventas por encima de 4M€, con volúmenes de ope-raciones cercanos a sus máximos históricos, como lo muestra el crecimiento de la barra amarilla "Más de 4M€". Esto refleja una creciente confianza entre compradores de ultra-lujo. Los precios también muestran un aumento con-sistente, especialmente en el rango de más de 4M€, su-perando los 8.000€/m2 en 2024.

2. Benahavís: Fortaleza en Alto Nivel, Moderación más Abajo. Benahavís presenta un panorama con más con-trastes. Las transacciones de propiedades por encima de 4M€ han aumentado respecto a años anteriores, atrayen-do un fuerte interés en el segmento alto como muestra la barra amarilla en el gráfico. Sin embargo, la actividad por debajo de 4M€ ha disminuido desde su pico de 2023, es-pecialmente para propiedades entre 1.5M€ y 4M€. El des-censo de las transacciones en los niveles inferiores tam-bién puede indicar una reducción del stock o un desajuste entre las expectativas de los vendedores y los presupues-tos de los compradores en ese segmento.

“Marbella atrae una demanda sólida con subidas de precios mientras que Benahavís, aunque fuerte en más alto nivel, tiene menos actividad en rangos medios.”

3. Evolución Variable de Precios. Las tendencias de pre-cios difieren entre ambas localidades. El segmento de Marbella de más de 4M€ muestra una aceleración notable en el crecimiento de precios, con una curva ascendente hasta 2024. En contraste, los precios en Benahavís para propiedades de más de 4M€ se mantienen más estables en 2024 tras un pico en 2023, y los precios entre 1.5M€ y 4M€ han suavizado su ascenso desde 2023. Estos patro-nes subrayan la importancia de una estrategia de precios precisa, basada en el tipo de propiedad, ubicación y ten-dencias de los compradores.

En resumen, Marbella sigue atrayendo una sólida deman-da de lujo, con una notable ascenso de precios. Benahavís, aunque fuerte en el rango más alto, muestra una actividad moderada en segmentos medios. El conocimiento preciso del mercado y el posicionamiento estratégico son, por tanto, vitales.

Artículo de:

Alfonso Lacruz

Marbella vs. Benahavis: Where is the Luxury Market headed in 2024?

The luxury real estate markets of Marbella and Benahavís continue their dynamic evolution into 2024, showing nota-ble shifts in pricing and buyer behavior. Understanding these market movements is essential for both buyers and sellers in today’s high-end landscape.

1. Marbella: Broad Growth Across Luxury Price Brackets. Marbella’s market has seen strong transactional activity across all luxury segments in 2024, in some cases exceed-ing 2022 levels. Properties from €1.5 million to €4 million remain most active, showing consistent appeal. Notably, sales above €4 million are at or near their highest volumes, with the "More than 4M€" segment showing significant growth. This reflects increasing confidence among ultra-luxury buyers. Prices are also rising robustly, particularly in the €4 million-plus range, surpassing €8,000/m2 by 2024.

2. Benahavís: Strength at the Top, Moderation Below. Benahavís presents a contrasting picture. Transactions above €4 million have increased compared to previous years, with top-tier homes attracting strong interest. The growing yellow bar confirms this "More than 4M€" activity. However, activity below €4 million has declined from its 2023 peak, especially for properties between €1.5 million and €4 million. The drop in lower-tier transactions may also signal reduced inventory or a mismatch between sell-er expectations and buyer budgets in that segment.

"Marbella attracts robust luxury demand with strong price appreciation while Benahavís, although strong at top, shows moderated activity in mid-luxury price."

3. Divergent Price Evolution. Price trends diverge be-tween the two areas. Marbella’s €4 million-plus segment shows accelerated price growth, driven by demand and limited supply, with a strong upward curve into 2024. In contrast, Benahavís prices for "More than 4M€" properties are more stable in 2024 after a 2023 peak, and €1.5 million to €4 million prices have softened slightly from their 2023 peak. These patterns highlight the need for precise pricing strategies based on property type, location, and buyer trends.

In summary, Marbella continues to attract robust top-tier luxury demand with strong price appreciation. Benahavís, while performing strongly at the very top, shows moderat-ed activity in mid-luxury price points. Accurate market knowledge and strategic positioning are thus vital for navi-gating these dynamic markets.

Article by:

Alfonso Lacruz

Calidad de vida, seguriudad y rentabilidad: Las claves del éxito inmobiliario en Marbella y Benahavís

Pensando en el porque inversores y las familias deberían considerar la compra de propiedades en Marbella y Benahavís y, basándome en algunos datos actuales del mercado - algunos de los cuales se incluyen en los gráficos adjuntos a este artículo - estas son, en mi opinión, las cinco razones principales por las que considero que es muy interesante comprar una propiedad en la zona en 2025 :

1. Fuerte revalorización del capital. Los precios de la vivienda en Marbella y Benahavís han experimentado un crecimiento constante en los últimos veinte años. Desde 2003, los precios por metro cuadrado se han más que duplicado. Incluso después de la crisis de 2008, el mercado repuntó con fuerza, superando en los últimos años la línea histórica de crecimiento anual del 4,5%. En 2024, los precios alcanzaron máximos históricos, lo que confirma el valor y la fiabilidad a largo plazo para inversores.

2. Tipos hipotecarios competitivos. Españaa ofrece actualmente algunos de los tipos hipotecarios más competitivos de Europa. Los tipos medios para hipotecas a 30 años están justo por encima de alrededor del 3% para españoles y justo por debajo del 4% para los compradores internacionales, lo que los hace muy atractivos en comparación con países como Estados Unidos, Reino Unido o Polonia, donde los tipos pueden superar el 5-7%.

"Invertir en Marbella y Benahavís en 2025 significa asegurarse crecimiento, estilo de vida, estabilidad y valor inmobiliario a largo plazo"

3. Precios más baratos que la competencia internacional de lujo. Aunque Marbella y Benahavís son conocidos por su estilo alto de vida, los precios de las propiedades siguen siendo significativamente más bajos que los de otros destinos de lujo internacionales, como se ve en el Gráfico 1. Por ejemplo, Montecarlo, París y Londres tienen precios por metro cuadrado mucho más altos - a menudo el doble o incluso el triple que en Marbella -, llegando incluso, en el caso de Montecarlo, a superar los 50.000 €/m2. Esto significa que los compradores obtienen más valor por su inversión sin renunciar a la calidad ni al prestigio.

4. Calidad de vida, seguridad y clima. Marbella y Benahavís ofrecen una calidad de vida excepcional, con más de 320 días de sol al año, buenas playas, campos de golf de nivel mundial y una gastronomía de renombre. La zona también es conocida por su seguridad y su acogedora comunidad internacional, lo que la hace ideal para familias, jubilados o profesionales que trabajan en remoto.

5. Ubicación estratégica, conectividad e infraestructuras. Situadas a sólo 40 minutos del Aeropuerto de Málaga, Marbella y Benahavís están excepcionalmente bien conectadas con el resto de Europa. La región cuenta con una excelente atención sanitaria, colegios internacionales y modernas infraestructuras, que garantizan la comodidad y el confort de residentes y visitantes.

Artículo de:

Alfonso Lacruz

5 Powerful reasons to Invest in Marbella & Benahavís this year.

I have been thinking why investors and families should consider buying real estate in Marbella and Benahavis and, after reviewing the latest data-sorne of which is included in the charts attached to this article-these are, in my view, the flve most compelling reasons why purchasing property in this area is a smart move in 2025 :

1. Strong Capital Appreciation. Property prices in Marbella and Benahavis have shown consistent growth over the last two decades. Since 2003, average prices per square meter have more than doubled. Even after the 2008 crisis, the market rebounded strongly, with recent years outperforming the historical 4.5% annual growth line. In 2024, prices hit record highs, conflrming long-term value and reliability for investors .

2. Competitive Mortgage Rates. Spain currently offers sorne of the most competitive mortgage rates in Europe. Average rates for 30-year mortgages are just above around 3% for locals and just under 4% for international buyers which make them attractively low compared to countries like the US, UK, or Poland, where rates can exceed 5-7%.

"lnvesting in Marbella and Benahavis in 2025 means securing growth, lifestyle, stability, and long-term property value."

3. Cheaper Prices Than lnternational Luxury Competition. While Marbella and Benahavis are renowned for its luxury lifestyle, its property prices remain signiflcantly lower than those in other international luxury destinations as it can be seen on Chart 1. For example, Monte Cario, Paris, and London all command much higher prices per square meter-often double or even triple those in Marbella- and, even, in the case of Monte Cario reaching the 50.000 €/m2 mark. This means buyers get more value for their investment without compromising on quality or prestige.

4. Quality of Life, Safety, and Climate. Marbella and Benahavis offer an exceptional quality of life, with over 320 days of sunshine per year, beautiful beaches, worldclass golf courses, and renowned gastronomy. The region is also known for its safety and welcoming international community, making it ideal for families, retirees, and remote workers alike.

5. Strategic Location, Connectivity, and lnfrastructure. Located just 40 minutes from Malaga lnternational Airport, Marbella and Benahavis are exceptionally well-connected to the rest of Europe. The region boasts excellent healthcare, international schools, and modern infrastructure, ensuring convenience and comfort for residents and visitors.

Article by:

Alfonso Lacruz

2024 Real Estate review: Marbella’s strength vs. Benahavís’s slowdown

The real estate market in Marbella and Benahavis continues to show resilience and unique dynamics, as reected in the latest transaction data for 2024 published recently by the Ministry of Housing. Based on the data presented in the charts, three key trends based on the market performance highlight the strengths and challenges of these two sought-after locations:

1. Q2: The Strongest Quarter for Sales. Both Marbella and Benahavis experienced their highest transaction vol-umes during Q2 in 2024. This period consistently outperformed other quarters across the years, reecting a seasonal peak in buyer activity. In Marbella, Q2 alone account-ed for a signicant portion of the nearly 5,000 units sold in 2024, while Benahavis saw similar patterns with Q2 leading its sales gures. This trend underscores the importance of timing for sellers aiming to capitalize on heightened market demand.

2. Marbella: Sustained Sales Growth Despite Market Fluctuations. Marbella´s real estate market maintained its robust trajectory, achieving nearly 5,000 units sold in 2024—well above its historical annual average of approximately 3,500 units. The market has demonstrated con-sistent growth since recovering from the global finantial crisis of 2008-2012, with strong performance across all quarters. Marbella remains a prime destination for both domestic and international buyers, driven by its reputation as a luxury hotspot and its ability to attract steady demand year after year. Looking ahead, 2025 is expected to sustain steady sales, aligning with long-term trends rather than short-term spikes.

3. Downward Trend in Benahavis. In contrast to Marbel-la’s resilience, Benahavis experienced a slight decline in sales over the past two years. After reaching record highs in 2022 with nearly 1,000 units sold, transaction volumes dipped in both 2023 and 2024, falling closer to its historical annual average of around 600 units. While Q2 remained the strongest quarter for Benahavis in 2024, the overall downward trend suggests a cooling off period after several years of rapid growth. This could indicate a shift in buyer preferences or maybe just buyers being more cautious about paying ambitious listing prices.

In summary, the real estate markets of Marbella and Benahavis showcased distinct trends in 2024. While Marbella continued its upward trajectory with strong sales concen-trated in Q2, Benahavis faced a slight decline after peaking in 2022. Both markets exhibit clear seasonal patterns, with Q2 emerging as the most active period for transactions. For buyers and investors, Marbella remains a stable and growing market, while Benahavis presents opportunities for those seeking value amidst its recent slowdown. Understanding these trends is key to making informed deci-sions in these prestigious real estate destinations.