Costa del Sol Market 2025: Asking Price vs. Sold Price Reality

Journal on the Real Estate Market of the Costa del Sol - December 2025

Lesser- Know Trails in Marbella and Its Surroundings for this Autumn

Discover six unique getaways to enjoy the colors and calm of the season

When we think of Marbella, the mind often jumps to its beaches, the luxury of Puerto Banús, or the vibrant nightlife of the Costa del Sol. Yet just a few kilometers away from the bustle, hidden hiking routes reveal their best side in autumn: landscapes painted in ochre and gold, fresh mountain air, and secret corners that invite you to disconnect.

Below, we present a selection of little-known trails in Marbella and its surroundings to enjoy during this magical season.

1.The Ruins of Daidín (Benahavís)

Hidden in the mountains between Benahavís and Ronda, the 9th-century ruins of Daidín reveal remnants of walls, towers, and cisterns overlooking the Guadalmina Valley. Surrounded by olive and almond trees, the trail offers stunning views and a journey back to the legacy of AI-Andalus in the heart of Málaga.

Approximate duration: 2 hours 30 minutes (round trip).

Tip: Avo id the central hours of the day and bring water; while not a long route, there is very little shade.

2.The Buenavista Mine (Marbella)

Hidden among pine forests, the Buenavista Mine blends industrial heritage with natural beauty. The trail passes old mining tunnels and structures overlooking the Mediterranean, glowing with golden light at sunset in autumn.

Approximate duration: 1 .5-2 hours (round trip).

Bring a flash light to explore the tunnels safely and avoid humid days, as the ground can get slippery.

3.The Wine Route (Manilva)

Beyond hiking, an escape through the vineyards of Manilva offers a different plan. lts moscatel grape fields, unique along the coast, turn golden and red in autumn. Several family-run wineries welcome visitors to learn about the winemaking process and taste traditional sweet wines.

Approximate duration: Half a day.

Tip: Book a winery visit to pair nature with tastings.

4.The Otter Pool (Estepona)

A natural gem hidden in the upper course of the Castor River in Estepona. The trail winds between rocks and small waterfalls until reaching a crystal-clear pool that gives the place its name: La Charca de las Nutrias - "The Otter Pool." The constant murmur of the river and the lush vegetation create an atmosphere of serenity, perfect for disconnecting. In autumn, the water level drops slightly, making it easier to walk along the riverbed and enjoy the absolute calm of this secluded spot.

5.Castillejos de Quintana (Istán)

Between lstán and the Concepción reservoir lie the ruins of a 9th-century Arab fortress. The trail leading there crosses Mediterranean scrubland dotted with natural springs. A little-visited site that blends history with nature.

Approximate duration: 2 hours.

Tip: Autumn is the best time to go, when the vegetation is green and the heat has eased.

6.The Pinsapo Forest of Sierra Bermeja (Estepona)

This natural enclave shelters one of the most impressive pinsapo (Spanish fir) forests in Andalusia, with centuries-old trees growing on the reddish soil that characterizes the sierra. The path ascends gently through curves up to a viewpoint overlooking the Costa del Sol - and on clear days, even the north of Africa. The fresh air and the scent of fir trees make this hike a truly sensory experience.

Approximate duration: 3-4 hours (round trip).

Tip: Best enjoyed on cloudy or rainy days, when the forest's colors deepen and the landscape feels more alive.

Tax Residency: A legal labyrinth across borders. Examples from the United Kingdom nd Netherlands

Establishing tax residency may seem straightforward, but in practice it is a complex process filled

with legal nuances that vary significantly between countries. These differences can lead to

paradoxical situations, especially for individuals who live, work, or invest across borders.

Spain: The 183-Day Rule and Econornic Nexus

Spain considers an individual a tax resident if they spend more than 183 days in the country during the calendar year.

AII days of physical presence count, even if only for a few hours, and overnight stays are not required. Sporadic absences are also included unless the person can prove tax residency in another country. A person is also deemed a tax resident if their main economic interests or business activities are based in Spain, or if their spouse and minar children live there. Even a single transit day through a Spanish airport may count as a day of residence.

United Kingdom: Overnight Stay and Personal Ties

The United Kingdom applies the Statutory Residence Test (SRT) to determine tax residency. This test takes into account the number of days spent in the UK with an overnight stay, as well as personal and professional ties and the availability of a home in the country. Spending 183 days or more in the UK during a tax year automatically makes an individual a tax resident. For those who are no longer residents but still maintain a home in the UK, staying more than 90 days per year can result in regaining tax residency status. Only days that include an overnight stay are counted, except for specific exemptions such as transit stops or aircrew duties. Additionally, from April 2025, non-domiciled individuals are required to pay taxes on their worldwide income, ending the previous preferential regime.

Netherlands: Centre of Life Over Number of Days

In the Netherlands, the number of days spent in the country is not the main criterion for determining tax residency.

lnstead, the focus lies on the centre of an individual's personal and economic life - where their habitual residence is, where their family lives and works, and where their bank accounts, insurance, and medical services are located. Although spending more than 183 days in the Netherlands may indicate residency, it is not a decisive factor. A person may still be considered a tax resident even with fewer days, if their life is primarily centred in the Netherlands

The Paradox of Dual Residency

lt is entirely possible-and often legally complex-to be considered a tax resident in more than one country.

For instance, a person who works in Spain during the day but returns to the UK to sleep could be treated as a resident in both jurisdictions: Spain, due to physical presence and economic activity, and the U K, due to overnight stays and personal ties. These situations require careful tax planning to prevent double taxation and ensure full compliance with the laws of each country.

Why Expert Advice Matters

Investing in Spain requires more than signing a contract - it demands understanding where and how to pay taxes, avoiding double taxation, and structuring operations correctly. Tax planning is essential.

MAGAZINE ON THE REAL ESTATE MARKET OF MARBELLA & BENAHAVIS AUTUMN 2025

THE HIDDEN COSTS OF LUXURV LIVING IN BENAHAVIS : TAXES, EXPENSES AND LIFESTYLE

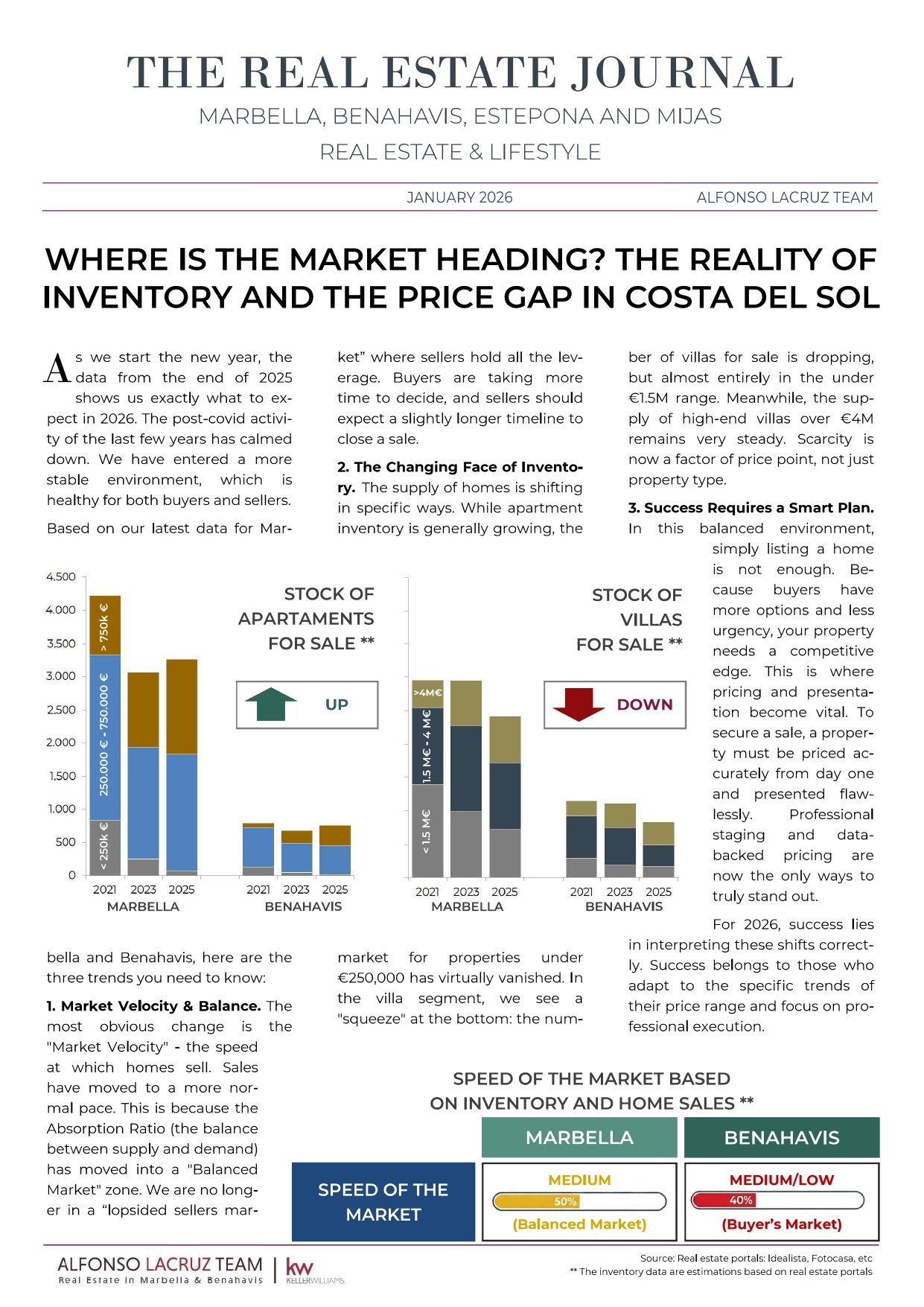

Purchasing a luxury villa in Benahavís is not just a real estate decision - it's about entering a lifestyle defined by privacy, security, and comfort. However, the true cost of ownership goes well beyond the listing price.

1. Initial Costs - On Purchase: In addition to the property price, buyers must factor in taxes (Transfer Tax for resales. or VAT and Stamp Duty for new builds). Notary and Land Registry fees, legal services and technical inspections. These costs typically range between 10- 12% of the purchase price. Keep in mind that rates may vary depending on the municipality and type of property.

2. Annual Costs & Property Taxes: Once the property is yours. ongoing expenses such as council tax (IBI), rubbish collection, community fees and home insurance become part of your annual budget. For nonresidents. income tax and wealth tax obligations may also apply, especially for properties not used as a primary residence.

"The true cost of ownership is more than square meters - it's how you live within them."

3. Lifestyle & Leisure: Families relocating full - or part-time to Benahavís should also plan for international school tuition, private health insurance, golf or sports club memberships, and regular dining or entertaining. These expenses enhance quality of life - but should be budgeted realistically from the start.

Note: The costs shown in the table are estimates for guidance only. Figures vary depending on lifestyle, residence status, property type and community services such as security or amenities. Taxes must be calculated individually.

For a tailored breakdown. contact our team to help you plan wisely and invest with confidence.

BRIDGING THE NEGOTIATION GAP: HOW PRICING SHAPES TODAY'S COSTA DEL SOL MARKET

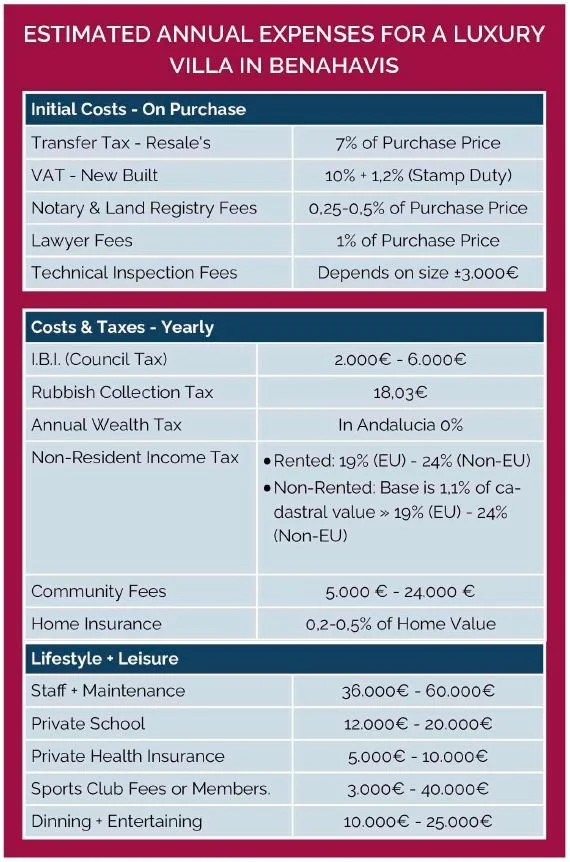

While long-term value remains exceptionally strong on the Costa del Sol. the market has reached a stage where seller expectations are drifting from buyer reality. Our latest data confirms that serious, informed buyers are still active but increasingly selective. This shift has widened the "Negotiation Gap," the space between the advertised asking price and the final closing price, now the key factor affecting liquidity and sales speed in the luxury segment.

1. The Excessive Gap: Expectations vs Market Value. The divergence between the Asking Price and the Closed Price (Land Registry) is the main reason transactions are slowing. The figures are striking: in Benahavis, the negotiation gap stands at 36%, equivalent to €1,341 per square meter, Marbella follows at 31% (€1,239/m2) and Estepona at 28%. These differences clearly show that many homes enter the market with asking prices buyers simply reject.

2. Market Friction and a Slower Sales Pace. This widening gap has led to a noticeable slowdown. Closed transactions in Marbella, Benahavís, and Mijas dropped by around 20% in Q2 2025 compared with the previous year. Marbella alone saw a 20.9% decline in units sold versus Q2 2024. Overpriced listings remain longer on the market. eroding buyer confidence and reducing overall momentum. The result is a cycle of inefficiency that slows the entire market.

3. The Solution: Price Coherence Protects Value. To reverse this trend, sellers must embrace realistic pricing from the start. Overpricing weakens negotiating power and often leads to harder final discounts. By contrast. properties priced in line with real demand attract serious buyers quickly and close closer to their asking value. A coherent valuation is not just a recommendation - it's a vital strategy to ensure a swift, secure sale and protect your capital.

In summary, demand remains robust and long-term fundamentals are strong, but achieving success today requires strategic, marketcoherent pricing that bridges the growing negotiation gap.

Journal on the Real Estate Market of the Costa del Sol - November 2025

COSTA DEL SOL REAL ESTATE MARKET Q2 2025: FEWER SALES, STABLE PRICES

The latest Land Registry data for the western Costa del Sol pre-sents a market that remains funda-mentally healthy but has clearly shifted in pace. Prices continue to trend upward, yet transaction vol-umes have dropped noticeably com-pared with the same period last year. After two exceptional years of strong activity, this moderation suggests the market is returning to a more sus-tainable rhythm rather than entering a downturn. Serious buyers are still active, but they are increasingly se-lective and value-driven, focusing on properties that combine quality, loca-tion, and realistic pricing.

1. Sales volumes have fallen sharply, but prices remain resilient. Closed transactions decreased by around 20% in Marbella, Benahavís, and Mijas during Q2, while Estepona was the only area to post a modest gain of +3.6%. Despite these declines, prices have continued to rise across most municipalities. This resilience highlights the strength of the local market, sup-ported by limited supply of modern homes and con-sistent demand from both domestic and international buyers.

2. Price trends di-verge across areas. Marbella and Estepona recorded quarterly price gains of +2.8% and +5.9%, while Mijas led the region with an impres-sive +21.2% annual increase. Bena-havís was the only market to show a small quarterly de-crease (–0.8%), suggesting a temporary pause after several years of growth, particu-larly in the high-end segment where buyer caution is more evident.

3. The gap between asking and sell-ing prices continues to widen. Since mid-2024, asking prices have risen faster than achieved sale prices, reflecting a growing disconnect be-tween seller expectations and buyer sentiment. While this may lead to longer marketing times, well-priced listings continue to attract strong interest, confirming that confidence in the Costa del Sol remains solid and long-term fundamentals are intact.

For homeowners, this means:

Well-priced homes will stand out this autumn, as buyers grow more selective and mo-tivated — making now the ideal moment to attract seri-ous offers before year-end.

Article by

Alfonso Lacruz

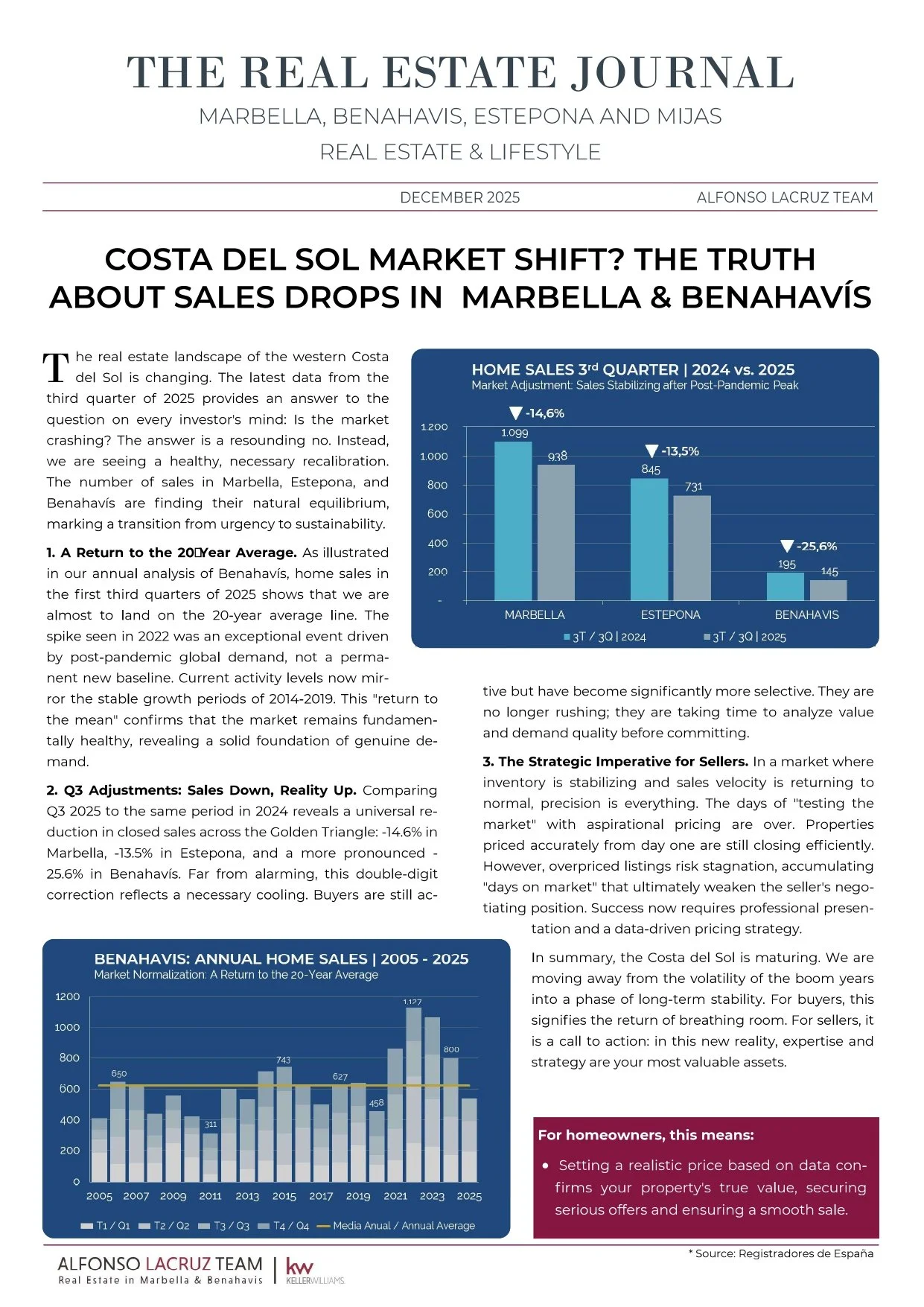

MARBELLA & BENAHAVIS MARKET INSIGHT: SUPPLY GAPS ACROSS PRICE RANGES

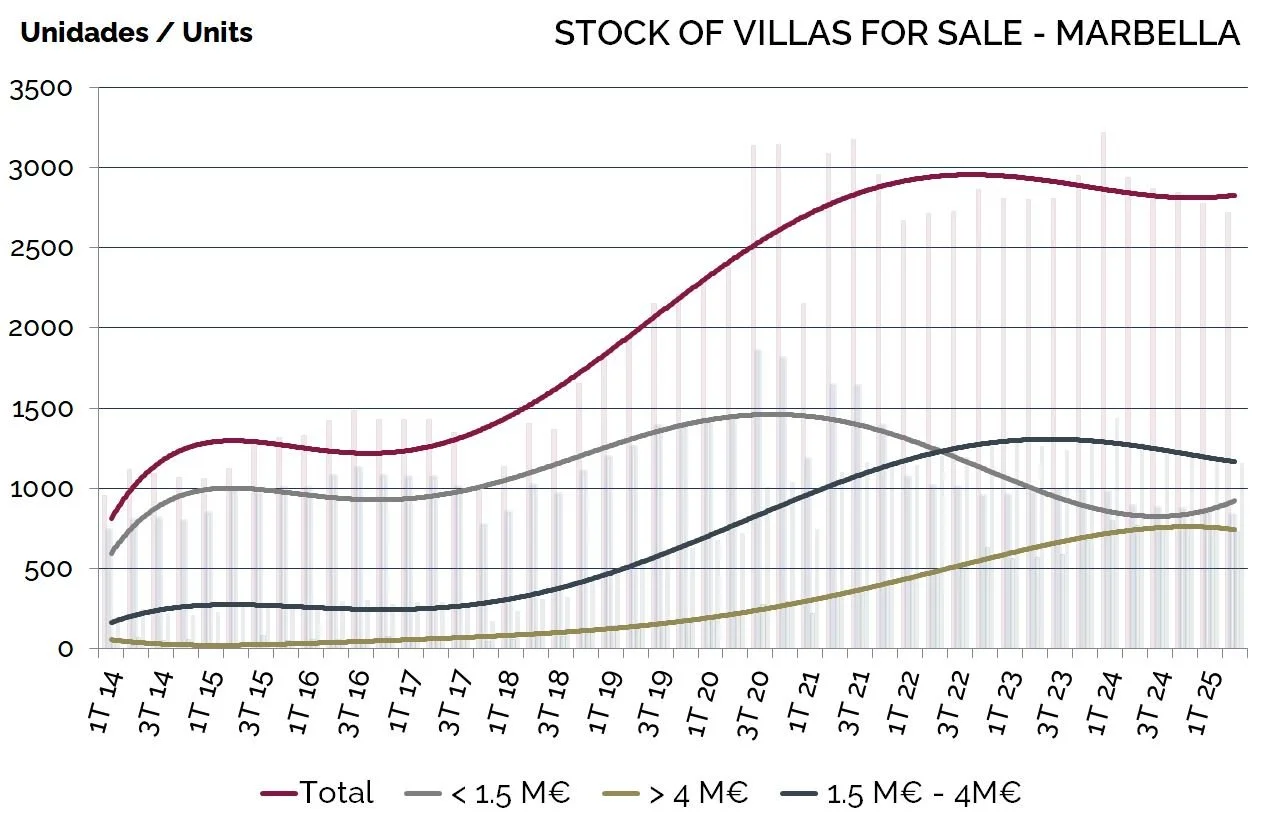

As we head into the last quarter of the year, Marbella’s real estate market reveals two contrasting stories: villas remain scarce, while apartments show increasing availability. Benahavís follows a similar trend, but Marbella offers the clearest picture.

1. Villas: Declining Supply

Villa stock is down –7.4% year over year, reinforcing scarcity in the detached home segment. The steepest drop is in the 1.5–4M€ range, where supply has tightened since 2022. At the very top, above 4M€, inventory has stabilized, while entry-level villas under 1.5M€ are now limited due to strong demand and minimal new builds.

2. Apartments: Rising Inventory.

In contrast, apartment stock has risen +14.5% compared with last year. Growth is strongest in the 250–750K€ segment, which remains highly active among both national and international buyers. High-end apartments above 750K€ are also expanding, supported by lifestyle demand and modern developments. At the same time, affordable options under 250K€ continue to shrink, reflecting how rare budget-friendly properties have become.

3. Diverging Dynamics.

The overall picture is one of polarization: scarcity in villas versus growing availability in apartments. Rather than a slowdown, demand is adjusting to value and supply across different price brackets.

For homeowners, this means:

· Villa sellers continue to benefit from limited competition, especially if positioned in the 1.5M€–4M€ range.

· Apartment owners will face more competition, but correctly priced and well-presented properties still attract significant buyer interest.

· Buyers should be aware that opportunities in the lower brackets are disappearing, while choice is increasing in mid-to-high-end apartments

ARTICLE BY ALFONSO LACRUZ Newsletter on the Real Estate Market of the Costa del Sol - October 2025

Newsletter on the Real Estate Market of the Costa del Sol - September 2025

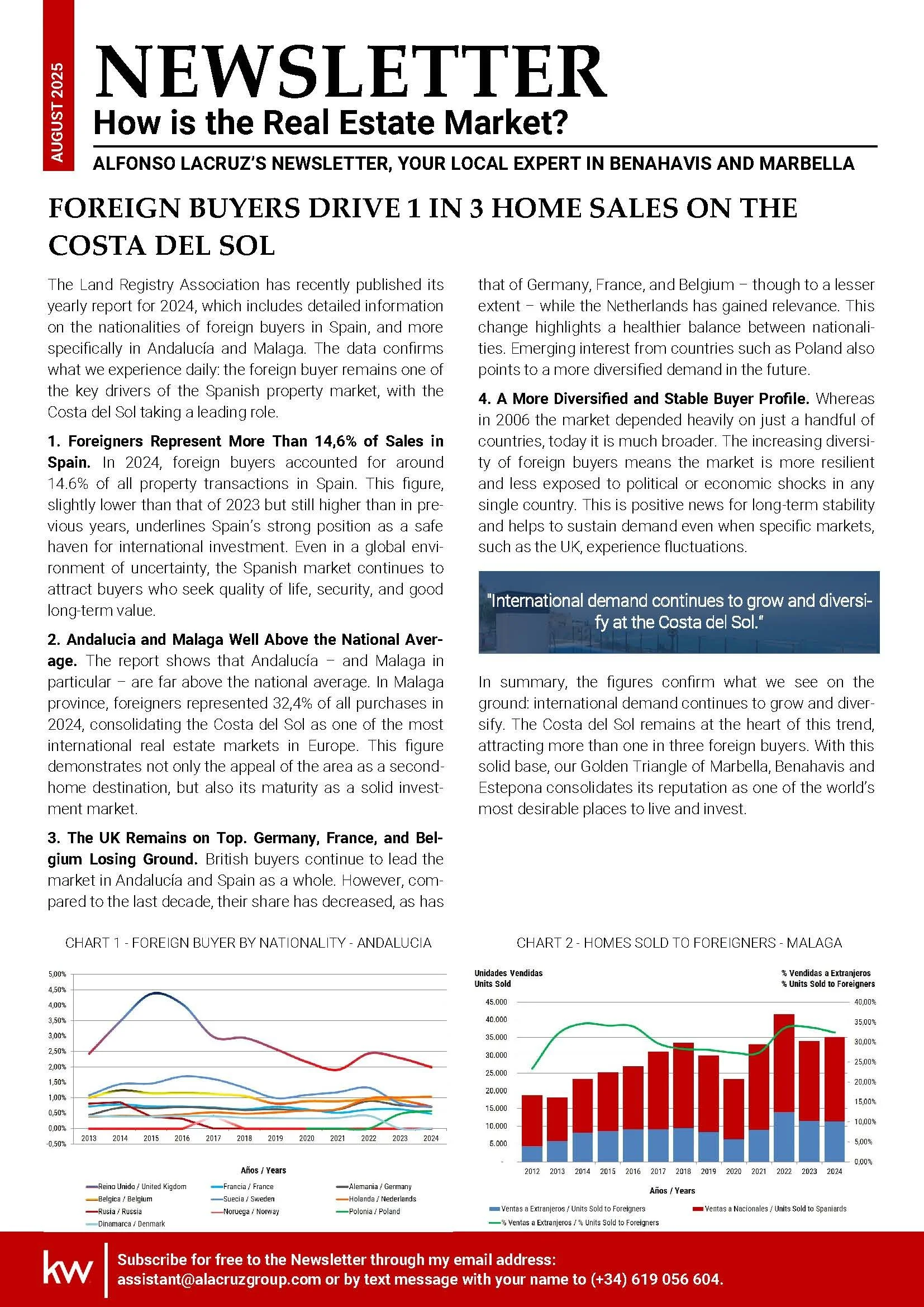

Newsletter on the Real Estate Market of the Costa del Sol - August 2025

Sustanaible Gardens

We design sustainable gardens based on environmental observation and the use of native, resilient plants. We apply Nature-Based Solutions (NbS) that replicate natural processes to address today’s social and environmental challenges.

CLIMATE-RESILIENT SPACES

Instead of using seasonal plants, we select species adapted to the local climate, such as Lavandula stoechas or Westringia fruticosa, which bloom at different times of the year, attract pollinators, and stimulate the senses. We avoid plants that may cause negative impacts, such as allergies or structural damage. Pest control is managed biologically, and we promote low-maintenance practices, avoiding unnecessary pruning. To reduce light pollution, we use amber lighting under 2700 Kelvin.

DROUGHT ADAPTATION

We replace grass with ground covers like Lippia nodiflora, which require minimal irrigation. Subsurface drip irrigation and organic or mineral mulching help retain moisture. Permeable surfaces and Sustainable Urban Drainage Systems (SUDs) are integrated into our designs to better manage drought and runoff. We choose low-water, climate-adapted plant communities that fit the existing soil with minimal amendments.

INVESTING IN NATURE IS INVESTING IN HEALTH

By planting species that attract pollinators, we create healthy spaces rich in ecosystem services: reducing CO₂, noise, and stress, improving social well-being, encouraging mental health, and strengthening our connection to nature.

ROSA CEÑO

LANDSCAPE DESIGNER

Master in Historic Gardens and Ecosystem Services of Green Infrastructure (UPM). Creator of projects such as El Jardín de los Sentidos (Marbella).

Awards include:

OJA AMJA First Prize and De-sign Week Marbella 2021.

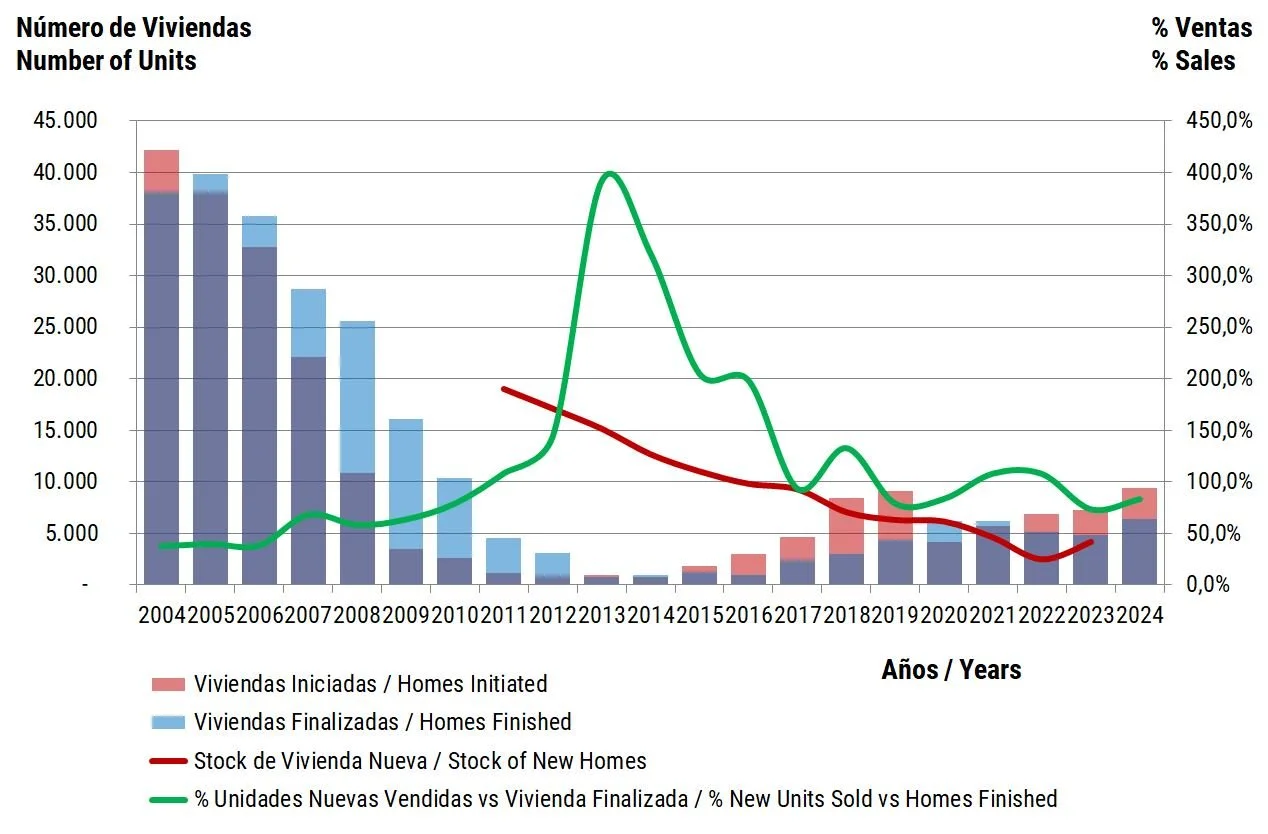

Malaga´s New Build Market 2024: Why demand is outrunning supply

The latest figures from the Ministry of Housing for 2024 confirm a trend I’ve been highlighting for the past two years: while demand for newly built homes remains strong across the province of Malaga, construction is still lagging behindintensifying pressure on supply and prices. Let’s look at what the data shows and why this matters for buyers, investors, and homeowners.

1. Stock of New Homes Remains Historically Low: The red line in the chart represents the stock of newly built homes available on the market. After peaking during the 2008 crisis, that stock has steadily decreased. In 2024, the stock remains well below pre-crisis levels, despite a moderate recovery in construction activity. This is a key difference compared to the 2004–2007 bubble years, when oversupply became a systemic risk.

2. Construction Has Not Returned to Boom Levels: The number of homes being completed (blue bars) and initiated (red bars) in 2024 is still a fraction of the peak seen in 2005. Back then, over 40,000 units were finished in one year, and even 83.000 in 2003. In contrast, 2024 barely reaches a quarter of that. Developers today are more cautious, and financing is stricter—good news for market stability, but a bottleneck for supply.

GRÁFICO 1 - OBRA NUEVA TERMINADA FRENTE A VENDIDA – MALAGA

“We are in a market deïfned by low inventory, contro-lled construction, and sustained demand."

3. Sales Continue to Outpace Deliveries: The green line in the chart—showing the % of new units sold vs. units finished—remains close to or above 100% in recent years. This means more homes are being sold than delivered, reducing available inventory. This dynamic fuels competition for high-quality properties, especially in prime areas like Marbella and Benahavís.

4. Price Pressure is Inevitable: With demand exceeding supply, prices for new builds continue to rise. As highlighted in my June 2024 newsletter, new developments in Marbella have seen average annual price increases of 17.9% over the past three years. This contrasts with second-hand properties, which have grown at 9.2% per year. Investors seeking capital appreciation and lifestyle buyers prioritizing quality are driving this upward trend.

In summary, we’re not witnessing a 2008-style bubble—far from it. Instead, we are in a market defined by low inventory, controlled construction, and sustained demand. For those considering a purchase or investment, especially in sought-after areas like Marbella and Bena-havis, understanding these trends is crucial. The best opportunities are being snapped up quickly and at increasingly higher prices.

Article by:

Alfonso Lacruz

Newsletter on the Real Estate Market of the Costa del Sol - July 2025

The Importance of Professional Photography in Property Sales

In today’s competitive real estate market, first impressions are everything. When a potential buyer views a property, the first thing they see is the listing—and in most cases, that listing is accompanied by images. Whether on a website, in a magazine, or a brochure, photography plays a crucial role in capturing attention, sparking interest, and ultimately influencing the decision to buy. A compelling presentation is essential, and the most effective way to achieve it is through high-quality professional photography.

Why Professional Photography is Key in High-End Real Estate

Studies show that listings with high-quality images receive 61% more views than those without photos. Properties with professional photography sell, on average, 32% faster than those with lower-quality visuals. Buyers form their first impressions based on the images they see—if the photos fail to highlight a property’s best features, it may never even make it onto a buyer’s shortlist. In a market where attention spans are short, a great image can make all the difference.

At Charly Simon Photo, we understand that capturing the essence of a home is about more than just taking pictures—it’s about telling a visual story that allows potential buyers to imagine themselves living in that space. With our expertise in architectural photography, we know what truly attracts buyers and how to communicate the unique personality of each property.

How Professional Photography Enhances the Sales Process

A strong visual presentation can significantly accelerate the sale of a property. Professional photographers bring both technical and artistic expertise to ensure that the home looks its absolute best. Mastery of light, angles, and composition is key to making spaces appear more expansive, welcoming, and distinctive. Whether it’s a modest apartment or a luxury villa, an experienced photographer knows how to accentuate key features while minimizing distractions.

In addition, drone photography has become an essential tool for showcasing properties in full. Aerial shots not only offer dynamic perspectives of the home but also highlight its surroundings—an important factor for buyers interested in location and lifestyle.

The Process: From Planning to Delivery

At Charly Simon Photo, we focus not only on delivering exceptional images but also on providing a seamless experience. We work closely with our clients to understand their goals and expectations. This tailored approach is especially relevant for luxury properties or architecturally unique homes. Each photo session is customized to highlight a property’s standout features, ensuring the final imagery truly reflects its value.

Once the shoot is complete, we move on to post-production, where lighting, color, and details are carefully adjusted to preserve the home’s authenticity while enhancing its appeal.

Conclusion: Investing in Professional Photography

Investing in professional photography is a strategic decision that should never be underestimated. High-quality images not only help sell a property faster but also ensure it receives the attention it deserves. In a highly competitive market, standing out is essential—and professional photography can be the deciding factor.

At Charly Simon Photo, we take pride in our attention to detail and our commitment to delivering an elevated experience. Whether photographing a luxury villa or a modern apartment, our mission is to make your property shine and leave a lasting impression on buyers—maximizing its potential and increasing the likelihood of a successful sale.

Article by:

Charly Simon

https://charlysimonphoto

Magazine on the Real Estate Market of Marbella & Benahavis - Summer 2025

Marbella & Benahavis Real Estate in 2025: Strong Foundations

With 25 years in the luxury real estate market of Marbella and Benahavis, I constantly analyze our dynamic land-scape based on the numbers of real estate. Latest data through early 2025 confïrms the market's resilience, showing Marbella's strong demand and Benahavis undergoing a healthy adjustment after peak growth. This continuous evolution highlights our region's enduring appeal and robust fundamentals. In delving into the specificscs, several relevant points emerge that paint a clearer picture of our current market.

1. Marbella's Enduring Strength: Marbella consistently performs above its long-term average. Despite some sales volume shifts in Q2 2024, Marbella has shown remarkable resilience. Q1 2025 started very strong, surpassing Q1 2024. This consistent performance, often exceeding prepandemic averages, indicates a stable and attractive market, a primary destination for buyers seeking high-quality lifestyles and solid investments.

2. Benahavis, Adjustment and Future Growth: After significant surges in 2021-2022, Benahavis is in an adjustment period. While 2023 and early 2024 saw reduced sales from peak highs, this is a healthy correction, not a downturn. 2024's total sales were above the 20-year aver-age, reflecting underlying strength. Benahavis offers exclu-sivity and larger plots, with this recalibration creating new opportunities. Q1 2025 shows renewed buyer interest, particularly for high-quality new builds.

"Marbella and Benahavis real estate markets conti-nue to demonstrate dynamism and resilience."

3. Navigating Market Nuances: Our market is balanced between supply and demand, with strong international buyer interest. While some segments saw reduced activity due to less inventory or higher pricing, the market as a whole progresses. Increased new-build availability offers more buyer options. Price stability, with increases in Marbella, reflects market health. Potential interest rate reductions could further stimulate demand, emphasizing the need for data-driven insights.

In summary, Marbella and Benahavis continue to demonstrate dynamism and resilience. While Benahavis adjusts post-peak, Marbella sustains its upward trajectory with strong demand and stable prices. The positive start to 2025, especially in Marbella, underscores our region's enduring appeal for luxury real estate. As an experienced agent and despite a personal feeling, as we do not have any data yet, that the market is cooling down in this sec-ond quarter of 2025, I remain confident in this vibrant market's long-term strength, driven by its unique lifestyle and sustained international buyer confidence.

Article by:

Alfonso Lacruz