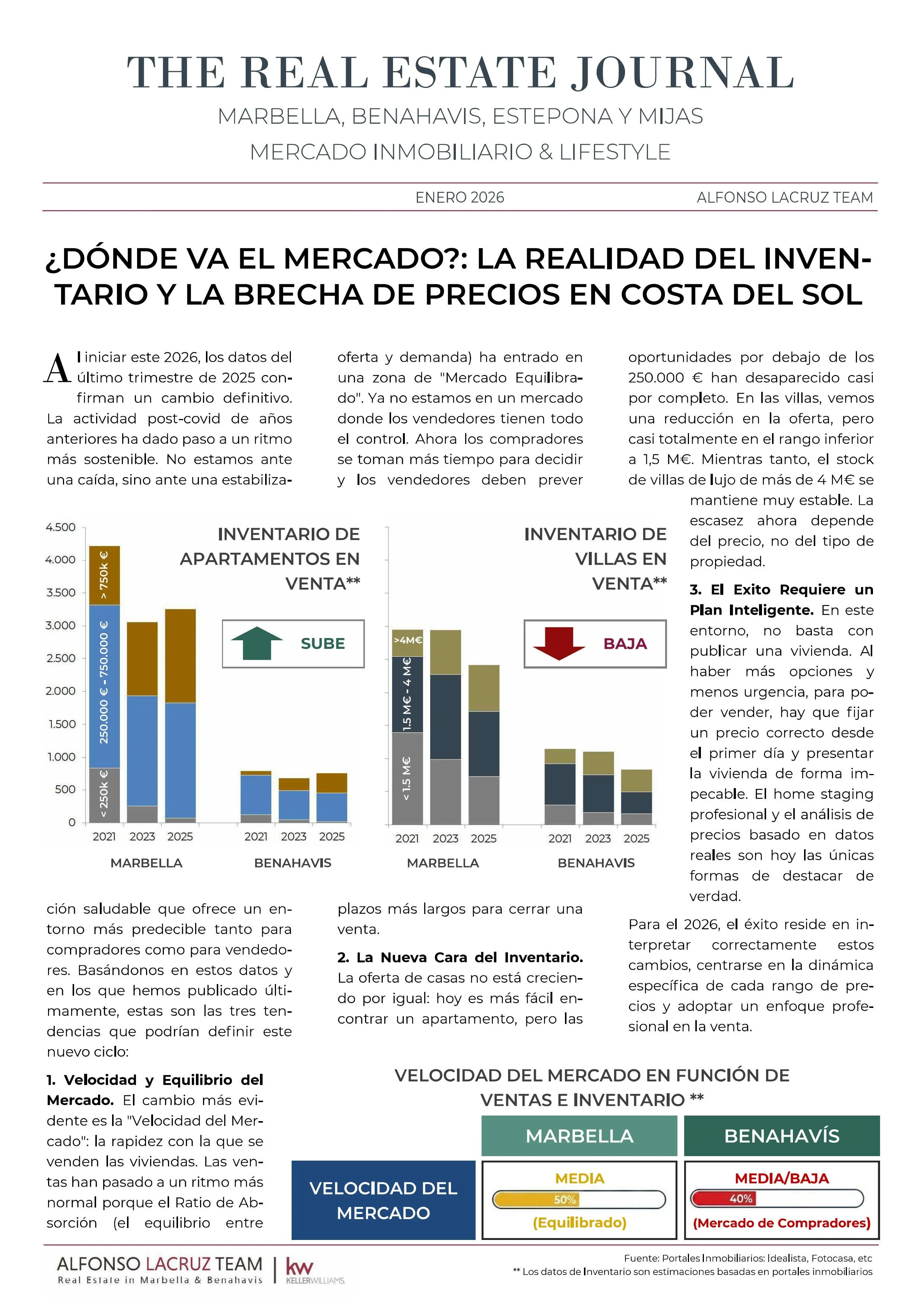

Journal sobre el mercado inmobiliario de la Costa de Sol - Enero 2026

Costa del Sol Market 2025: Asking Price vs. Sold Price Reality

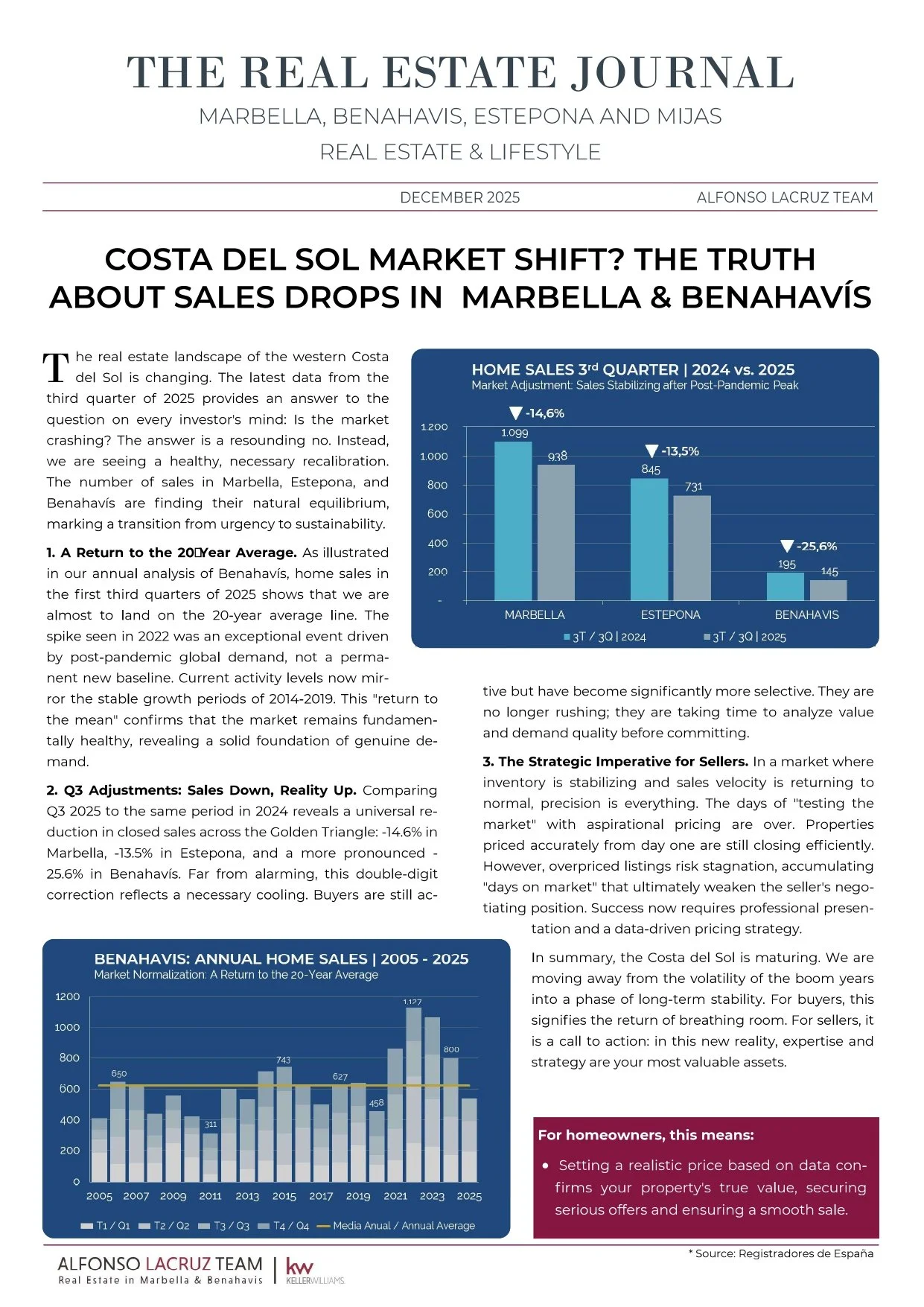

Journal sobre el Mercado Inmobiliario de la Costa del Sol - Diciembre 2025

Journal on the Real Estate Market of the Costa del Sol - December 2025

Lesser- Know Trails in Marbella and Its Surroundings for this Autumn

Discover six unique getaways to enjoy the colors and calm of the season

When we think of Marbella, the mind often jumps to its beaches, the luxury of Puerto Banús, or the vibrant nightlife of the Costa del Sol. Yet just a few kilometers away from the bustle, hidden hiking routes reveal their best side in autumn: landscapes painted in ochre and gold, fresh mountain air, and secret corners that invite you to disconnect.

Below, we present a selection of little-known trails in Marbella and its surroundings to enjoy during this magical season.

1.The Ruins of Daidín (Benahavís)

Hidden in the mountains between Benahavís and Ronda, the 9th-century ruins of Daidín reveal remnants of walls, towers, and cisterns overlooking the Guadalmina Valley. Surrounded by olive and almond trees, the trail offers stunning views and a journey back to the legacy of AI-Andalus in the heart of Málaga.

Approximate duration: 2 hours 30 minutes (round trip).

Tip: Avo id the central hours of the day and bring water; while not a long route, there is very little shade.

2.The Buenavista Mine (Marbella)

Hidden among pine forests, the Buenavista Mine blends industrial heritage with natural beauty. The trail passes old mining tunnels and structures overlooking the Mediterranean, glowing with golden light at sunset in autumn.

Approximate duration: 1 .5-2 hours (round trip).

Bring a flash light to explore the tunnels safely and avoid humid days, as the ground can get slippery.

3.The Wine Route (Manilva)

Beyond hiking, an escape through the vineyards of Manilva offers a different plan. lts moscatel grape fields, unique along the coast, turn golden and red in autumn. Several family-run wineries welcome visitors to learn about the winemaking process and taste traditional sweet wines.

Approximate duration: Half a day.

Tip: Book a winery visit to pair nature with tastings.

4.The Otter Pool (Estepona)

A natural gem hidden in the upper course of the Castor River in Estepona. The trail winds between rocks and small waterfalls until reaching a crystal-clear pool that gives the place its name: La Charca de las Nutrias - "The Otter Pool." The constant murmur of the river and the lush vegetation create an atmosphere of serenity, perfect for disconnecting. In autumn, the water level drops slightly, making it easier to walk along the riverbed and enjoy the absolute calm of this secluded spot.

5.Castillejos de Quintana (Istán)

Between lstán and the Concepción reservoir lie the ruins of a 9th-century Arab fortress. The trail leading there crosses Mediterranean scrubland dotted with natural springs. A little-visited site that blends history with nature.

Approximate duration: 2 hours.

Tip: Autumn is the best time to go, when the vegetation is green and the heat has eased.

6.The Pinsapo Forest of Sierra Bermeja (Estepona)

This natural enclave shelters one of the most impressive pinsapo (Spanish fir) forests in Andalusia, with centuries-old trees growing on the reddish soil that characterizes the sierra. The path ascends gently through curves up to a viewpoint overlooking the Costa del Sol - and on clear days, even the north of Africa. The fresh air and the scent of fir trees make this hike a truly sensory experience.

Approximate duration: 3-4 hours (round trip).

Tip: Best enjoyed on cloudy or rainy days, when the forest's colors deepen and the landscape feels more alive.

Tax Residency: A legal labyrinth across borders. Examples from the United Kingdom nd Netherlands

Establishing tax residency may seem straightforward, but in practice it is a complex process filled

with legal nuances that vary significantly between countries. These differences can lead to

paradoxical situations, especially for individuals who live, work, or invest across borders.

Spain: The 183-Day Rule and Econornic Nexus

Spain considers an individual a tax resident if they spend more than 183 days in the country during the calendar year.

AII days of physical presence count, even if only for a few hours, and overnight stays are not required. Sporadic absences are also included unless the person can prove tax residency in another country. A person is also deemed a tax resident if their main economic interests or business activities are based in Spain, or if their spouse and minar children live there. Even a single transit day through a Spanish airport may count as a day of residence.

United Kingdom: Overnight Stay and Personal Ties

The United Kingdom applies the Statutory Residence Test (SRT) to determine tax residency. This test takes into account the number of days spent in the UK with an overnight stay, as well as personal and professional ties and the availability of a home in the country. Spending 183 days or more in the UK during a tax year automatically makes an individual a tax resident. For those who are no longer residents but still maintain a home in the UK, staying more than 90 days per year can result in regaining tax residency status. Only days that include an overnight stay are counted, except for specific exemptions such as transit stops or aircrew duties. Additionally, from April 2025, non-domiciled individuals are required to pay taxes on their worldwide income, ending the previous preferential regime.

Netherlands: Centre of Life Over Number of Days

In the Netherlands, the number of days spent in the country is not the main criterion for determining tax residency.

lnstead, the focus lies on the centre of an individual's personal and economic life - where their habitual residence is, where their family lives and works, and where their bank accounts, insurance, and medical services are located. Although spending more than 183 days in the Netherlands may indicate residency, it is not a decisive factor. A person may still be considered a tax resident even with fewer days, if their life is primarily centred in the Netherlands

The Paradox of Dual Residency

lt is entirely possible-and often legally complex-to be considered a tax resident in more than one country.

For instance, a person who works in Spain during the day but returns to the UK to sleep could be treated as a resident in both jurisdictions: Spain, due to physical presence and economic activity, and the U K, due to overnight stays and personal ties. These situations require careful tax planning to prevent double taxation and ensure full compliance with the laws of each country.

Why Expert Advice Matters

Investing in Spain requires more than signing a contract - it demands understanding where and how to pay taxes, avoiding double taxation, and structuring operations correctly. Tax planning is essential.

MAGAZINE ON THE REAL ESTATE MARKET OF MARBELLA & BENAHAVIS AUTUMN 2025

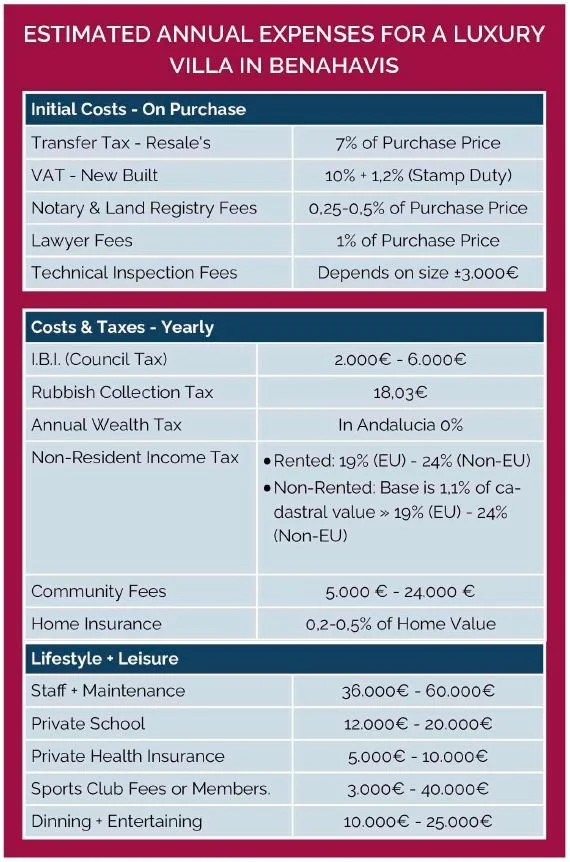

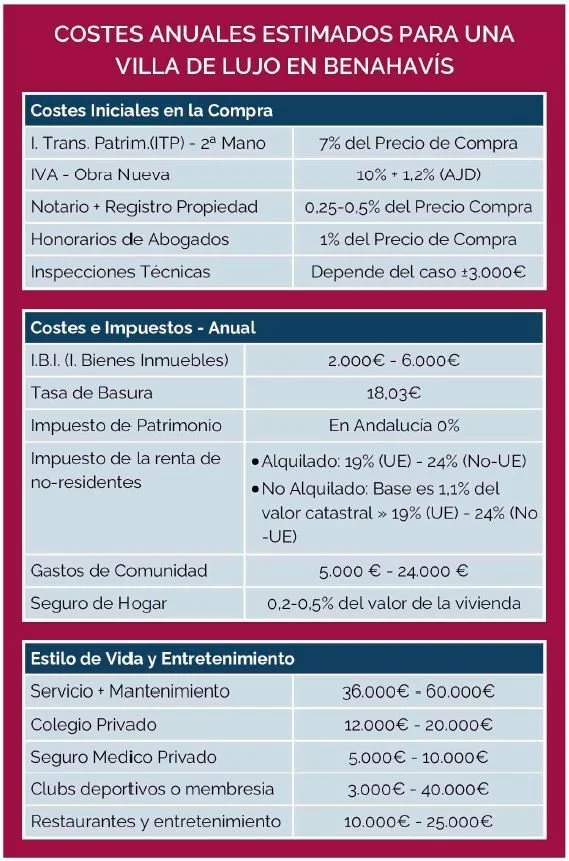

THE HIDDEN COSTS OF LUXURV LIVING IN BENAHAVIS : TAXES, EXPENSES AND LIFESTYLE

Purchasing a luxury villa in Benahavís is not just a real estate decision - it's about entering a lifestyle defined by privacy, security, and comfort. However, the true cost of ownership goes well beyond the listing price.

1. Initial Costs - On Purchase: In addition to the property price, buyers must factor in taxes (Transfer Tax for resales. or VAT and Stamp Duty for new builds). Notary and Land Registry fees, legal services and technical inspections. These costs typically range between 10- 12% of the purchase price. Keep in mind that rates may vary depending on the municipality and type of property.

2. Annual Costs & Property Taxes: Once the property is yours. ongoing expenses such as council tax (IBI), rubbish collection, community fees and home insurance become part of your annual budget. For nonresidents. income tax and wealth tax obligations may also apply, especially for properties not used as a primary residence.

"The true cost of ownership is more than square meters - it's how you live within them."

3. Lifestyle & Leisure: Families relocating full - or part-time to Benahavís should also plan for international school tuition, private health insurance, golf or sports club memberships, and regular dining or entertaining. These expenses enhance quality of life - but should be budgeted realistically from the start.

Note: The costs shown in the table are estimates for guidance only. Figures vary depending on lifestyle, residence status, property type and community services such as security or amenities. Taxes must be calculated individually.

For a tailored breakdown. contact our team to help you plan wisely and invest with confidence.

LA BRECHA DE PRECIOS ESTÁ FRENANDO EL RITMO DEL MERCADO INMOBILIARIO DE LA COSTA DEL SOL

Aunque la solidez estructural del mercado en la Costa del Sol se mantiene, el escenario actual muestra que las expectativas de los vendedores se alejan cada vez más de la realidad del comprador. Los datos más recientes confirman que los compradores serios y bien informados siguen activos, pero son cada vez más selectivos. Esto ha ampliado la llamada "brecha de negociación", el espacio entre el precio que se pide por las viviendas y el precio final de cierre, que hoy es el principal factor que afecta a la liquidez y la velocidad de venta en el segmento de lujo.

1. Una brecha excesiva entre expectativa y valor real: la diferencia entre el precio de salida y el precio de cierre (del Registro de la Propiedad) se ha convertido en el mayor freno del mercado. Las cifras son contundentes: en Benahavís, la brecha alcanza ya el 36%, lo que supone 1.341 €/m² de diferencia. Marbella le sigue con un 31% (1.239 €/m²), y Estepona con un 28%. Este desfase refleja que muchas propiedades salen al mercado con precios que los compradores simplemente no están dispuestos a aceptar.

2. Fricción y un ritmo de ventas más lento: este aumento del desfase ha provocado una clara desaceleración. En el segundo trimestre de 2025. las compraventas en Marbella, Benahavís y Mijas cayeron alrededor de un 20% respecto al año anterior. Solo en Marbella, el número de operaciones bajó un 20.9% frente al segundo trimestre de 2024. Las viviendas sobrevaloradas permanecen más tiempo en el mercado, generan desconfianza y frenan el ritmo general.

3. La solución: coherencia en el precio para proteger el valor. Para revertir esta tendencia, los vendedores deben apostar por la realidad del mercado desde el inicio. Un precio coherente atrae compradores serios, acorta los plazos y evita reducciones posteriores. En resumen, la demanda sigue siendo sólida y las perspectivas a largo plazo continúan siendo positivas, pero el éxito hoy depende de una estrategia de precio realista у alineada con el mercado, саpaz de cerrar con éxito la creciente brecha de negociación.

VIVIR EN BENAHAVIS: EL VERDADERO COSTE DEL LUJO. IMPUESTOS, GASTOS Y ESTILO DE VIDA

Comprar una villa de lujo en Benahavís no es una decisión meramente inmobiliaria: es entrar de lleno en un estilo de vida definido por la privacidad, la seguridad y el confort. Sin embargo, el verdadero coste de la vivienda va mucho más allá del precio de compra.

1. Costes iniciales - En La compra. Además del precio de la propiedad, los compradores deben tener en cuenta los impuestos (Transmisiones Patrimoniales para reventas, o IVA y Actos Jurídicos Documentados en obra nueva), los honorarios de Notaría y Registro, los gastos de abogados y las inspecciones técnicas.

En conjunto, suelen representar entre 10% y el 12% del precio de compra. Conviene recordar que los importes pueden variar entre según el municipio y el tipo de propiedad.

2. Costes anuales e impuestos. Una vez adquirida la vivienda, entran en juego gastos recurrentes como el IBI. la tasa de basura, las cuotas de comunidad y el seguro de hogar. En el caso de no residentes, también se aplican el impuesto sobre la renta y el impuesto sobre el patrimonio, especialmente si la propiedad no se utiliza como residencia habitual.

3. Estilo de vida y entretenimiento. Las familias que se trasladan total o parcialmente a Benahavís deben contemplar también gastos como colegios internacionales, seguros médicos privados, membresías en clubes de golf o deportivos, y cenas o actividades de ocio. Estos costes elevan la calidad de vida, pero conviene presupuestarlos desde el principio.

Nota: Los importes indicados en la tabla son estimaciones orientativas. Las cifras pueden variar según el estilo de vida, la condición fiscal del propietario, el tipo de vivienda y los servicios disponibles en la comunidad, como seguridad o servicios. Los impuestos deben calcularse individualmente.

Contacte con nuestro equipo y le ayudaremos a planificar e invertir con confianza.

BRIDGING THE NEGOTIATION GAP: HOW PRICING SHAPES TODAY'S COSTA DEL SOL MARKET

While long-term value remains exceptionally strong on the Costa del Sol. the market has reached a stage where seller expectations are drifting from buyer reality. Our latest data confirms that serious, informed buyers are still active but increasingly selective. This shift has widened the "Negotiation Gap," the space between the advertised asking price and the final closing price, now the key factor affecting liquidity and sales speed in the luxury segment.

1. The Excessive Gap: Expectations vs Market Value. The divergence between the Asking Price and the Closed Price (Land Registry) is the main reason transactions are slowing. The figures are striking: in Benahavis, the negotiation gap stands at 36%, equivalent to €1,341 per square meter, Marbella follows at 31% (€1,239/m2) and Estepona at 28%. These differences clearly show that many homes enter the market with asking prices buyers simply reject.

2. Market Friction and a Slower Sales Pace. This widening gap has led to a noticeable slowdown. Closed transactions in Marbella, Benahavís, and Mijas dropped by around 20% in Q2 2025 compared with the previous year. Marbella alone saw a 20.9% decline in units sold versus Q2 2024. Overpriced listings remain longer on the market. eroding buyer confidence and reducing overall momentum. The result is a cycle of inefficiency that slows the entire market.

3. The Solution: Price Coherence Protects Value. To reverse this trend, sellers must embrace realistic pricing from the start. Overpricing weakens negotiating power and often leads to harder final discounts. By contrast. properties priced in line with real demand attract serious buyers quickly and close closer to their asking value. A coherent valuation is not just a recommendation - it's a vital strategy to ensure a swift, secure sale and protect your capital.

In summary, demand remains robust and long-term fundamentals are strong, but achieving success today requires strategic, marketcoherent pricing that bridges the growing negotiation gap.

Newsletter sobre el mercado inmobiliario de la Costa del Sol - Noviembre 2025

Journal on the Real Estate Market of the Costa del Sol - November 2025

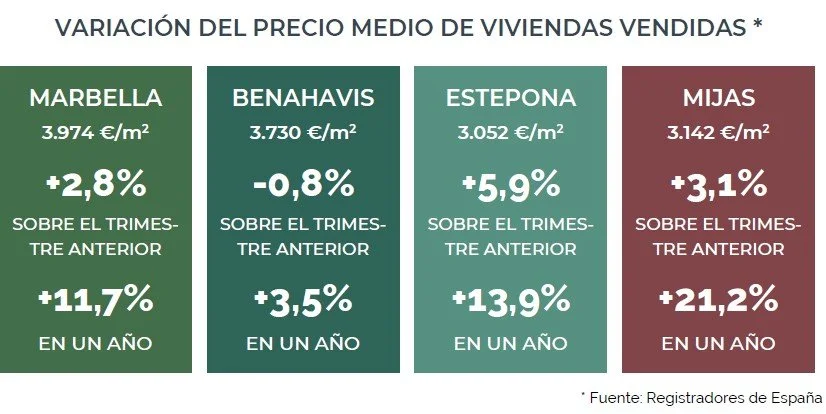

THE TRUTH ABOUT RESALE VALUE IN BENAHAVÍS: PRESTIGE VS. MARKET REALITY

Benahavís, the jewel in the hills of the Costa del Sol and part of the Golden Triangle with Marbella and Estepona, combines prestige with the highest income per capita in Andalusia. Yet behind its reputation lies a more nuanced reality regarding resale value and liquidity.

1. Supply: Scarcity as a Safeguard. Limited new development continues to support prices. Strict planning rules and a shortage of available land - especially for apartments concentrated in Real de La Quinta - keep supply tight. In past cycles, new builds made up 70 % of sales; during the last five years they averaged 10 %, reaching a record low of only 2 % in 2025.

2. Cooling Signs: The Gap Between Asking and Achieved Prices. In Benahavís, price data often reflects asking rather than actual sale values, creating false expectations among sellers. Over the past twelve months, the average gap reached 31.4%, while transactions fell around 20% in Q2 compared with the same quarter of 2024 - usually the most active of the year. The figures reveal growing market caution, where achieving premium prices requires realistic valuation and top presentation standards.

3. Liquidity: Patience Required. Prime properties may achieve 7,000–9,000 €/m², yet finding the right buyer can take time. The luxury and ultra-luxury markets rely on a smaller, more selective pool. For mid-high-end homes, realistic pricing is essential to avoid long market exposure.

4. What Protects Resale Value

Location: sea views, south orientation, or proximity to golf.

Condition: renovated, modernized homes sell faster and closer to asking.

Exclusivity: gated privacy remains a premium.

Market Positioning: villas 1.5 – 4 M€ and 250 - 750 k€ apartments attract steady demand.

5. Takeaways for Buyers and Sellers

Buyers: resale homes offer immediate availability; scarcity of new builds supports long-term security.

Sellers: premium pricing applies only to properties in excellent condition— overpricing risks extended exposure and weaker negotiation power.

In summary, Benahavís remains one of the Costa del Sol’s most secure investment markets. Scarcity, global demand, and lifestyle appeal sustain values—but success depends on realistic price expectations and quality.

Article by

Alfonso Lacruz

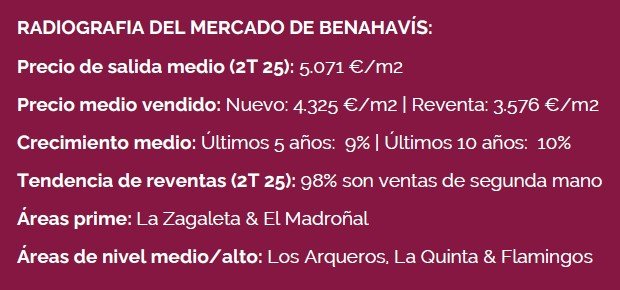

COSTA DEL SOL REAL ESTATE MARKET Q2 2025: FEWER SALES, STABLE PRICES

The latest Land Registry data for the western Costa del Sol pre-sents a market that remains funda-mentally healthy but has clearly shifted in pace. Prices continue to trend upward, yet transaction vol-umes have dropped noticeably com-pared with the same period last year. After two exceptional years of strong activity, this moderation suggests the market is returning to a more sus-tainable rhythm rather than entering a downturn. Serious buyers are still active, but they are increasingly se-lective and value-driven, focusing on properties that combine quality, loca-tion, and realistic pricing.

1. Sales volumes have fallen sharply, but prices remain resilient. Closed transactions decreased by around 20% in Marbella, Benahavís, and Mijas during Q2, while Estepona was the only area to post a modest gain of +3.6%. Despite these declines, prices have continued to rise across most municipalities. This resilience highlights the strength of the local market, sup-ported by limited supply of modern homes and con-sistent demand from both domestic and international buyers.

2. Price trends di-verge across areas. Marbella and Estepona recorded quarterly price gains of +2.8% and +5.9%, while Mijas led the region with an impres-sive +21.2% annual increase. Bena-havís was the only market to show a small quarterly de-crease (–0.8%), suggesting a temporary pause after several years of growth, particu-larly in the high-end segment where buyer caution is more evident.

3. The gap between asking and sell-ing prices continues to widen. Since mid-2024, asking prices have risen faster than achieved sale prices, reflecting a growing disconnect be-tween seller expectations and buyer sentiment. While this may lead to longer marketing times, well-priced listings continue to attract strong interest, confirming that confidence in the Costa del Sol remains solid and long-term fundamentals are intact.

For homeowners, this means:

Well-priced homes will stand out this autumn, as buyers grow more selective and mo-tivated — making now the ideal moment to attract seri-ous offers before year-end.

Article by

Alfonso Lacruz

LA VERDAD SOBRE EL VALOR DE REVENTA EN BENAHAVÍS: PRESTIGIO FRENTE A REALIDAD DEL MERCADO

Benahavís, la joya de la Costa del Sol y parte del Triángu-lo de Oro junto a Marbella y Estepona, combina presti-gio, exclusividad y la renta per cápita más alta de Andalucía. Su reputación como destino residencial de lujo está consoli-dada, pero conviene analizar la realidad del mercado en cuanto a valor de reventa y liquidez.

1. Oferta: la escasez es la defensa del valor. La falta de obra nueva sigue sosteniendo los precios. El urbanismo y la escasez de suelo - especialmente para apartamentos, don-de prácticamente solo queda suelo en Real de La Quinta - limitan la oferta. En el ciclo de 2008 la obra nueva represen-taba el 70 % de las ventas; en los últimos cinco años apenas el 10 %, alcanzando un mínimo del 2 % en 2025.

2. Señales de enfriamiento: la brecha entre precio de ofer-ta y cierre. Los datos publicados de precios reflejan a me-nudo expectativas, no valores reales, generando falsas es-peranzas entre los vendedores. En los últimos doce meses, la diferencia media entre precio de salida y cierre fue del 31,4%, mientras las ventas bajaron un 20% en el segundo trimestre respecto a 2024, tradicionalmente el más activo. El mercado exige mayor realismo: alcanzar precios premium requiere un valor ajustado y una presentación impecable.

3. Liquidez: paciencia y estrategia. Las propiedades de alta gama alcanzan entre 7.000 y 9.000 €/m², pero pueden tar-dar en venderse por el reducido grupo de compradores potenciales. En el rango medio-alto, ajustar el precio al mer-cado evita que una venta se alargue y pérdida de atractivo.

4. Factores que protegen el valor de reventa:

Ubicación: vistas abiertas al mar, orientación sur o cerca-nía a campos de golf.

Estado: viviendas renovadas o modernizadas se venden antes y más cerca del precio de salida.

Exclusividad: la privacidad en comunidades cerradas si-gue siendo un valor premium.

Posicionamiento: villas entre 1,5 y 4 M€ y apartamentos entre 250 y 750 k€ mantienen demanda constante.

5. Claves para compradores y vendedores:

Compradores: la falta de obra nueva re-fuerza el valor a largo plazo de las reventas.

Vendedores: los precios premium solo se logran con propiedades en excelente estado; precios caros implican más tiempo en el mercado y menor capacidad de negociación.

En resumen, Benahavís sigue siendo uno de los mercados más sólidos y seguros de la Costa del Sol. La escasez, la demanda y su estilo de vida sostienen los valores, aunque el éxito depende cada vez más de la realidad del precio, la calidad y la estrategia de venta

Artículo de

Alfonso Lacruz

MERCADO INMOBILIARIO DE LA COSTA DEL SOL: BAJAN LAS VENTAS, LOS PRECIOS SE MANTIENEN ESTABLES

Los últimos datos del Registro de la Propiedad reflejan un mercado que sigue mostrando solidez, aunque

con un ritmo más lento. Los precios continúan al alza, pero el número de compraventas ha caído de forma notable respecto al mismo periodo del año anterior. Tras dos ejercicios de gran actividad, esta moderación parece más un ajuste natural que una corrección. Los compradores siguen activos, aunque cada vez son más selectivos y valoran la calidad, la ubicación y, sobre todo, un precio coherente con el mercado actual.

1. Las ventas caen con fuerza, pero los precios se mantienen firmes. Durante el segundo trimestre, las

operaciones cerradas descendieron alrededor de un 20% en Marbella, Benahavís y Mijas, mientras que Estepona fue la única zona en registrar un leve incremento (+3,6%). A pesar de ello, los precios medios siguen mostrando una evolución positiva en la mayoría de municipios, lo que evidencia que la demanda

para viviendas bien presentadas y situadas en buenas ubicaciones continúa siendo sólida y estable.

2. Evolución desigual según la zona. Marbella y Estepona registraron aumentos trimestrales del +2,8% y +5,9%, respectivamente, mientras que Mijas lideró el crecimiento anual con un notable +21,2%. Benahavís

fue la excepción, con un ligero descenso (–0,8%) que apunta más a una pausa técnica tras varios años de fuerte apreciación, sobretodo en el segmento de lujo, donde el comprador se muestra más analítico y paciente.

3. Aumenta la brecha entre precio de oferta y precio de cierre. Desde mediados de 2024, los precios de

salida han crecido más rápido que los precios finales de venta, reflejando una mayor cautela entre los compradores y una cierta rigidez entre los vendedores. Aun así, las viviendas correctamente valoradas siguen atrayendo interés real, confirmando que la confianza en la Costa del Sol se mantiene firme y con fundamentos sólidos a largo plazo

Para propietarios, significa: Las viviendas con un precio realista de mercado destacarán este otoño, cuando los compradores son más selectivos pero decididos, siendo un tiempo ideal para vender.

Artículo de

Alfonso Lacruz

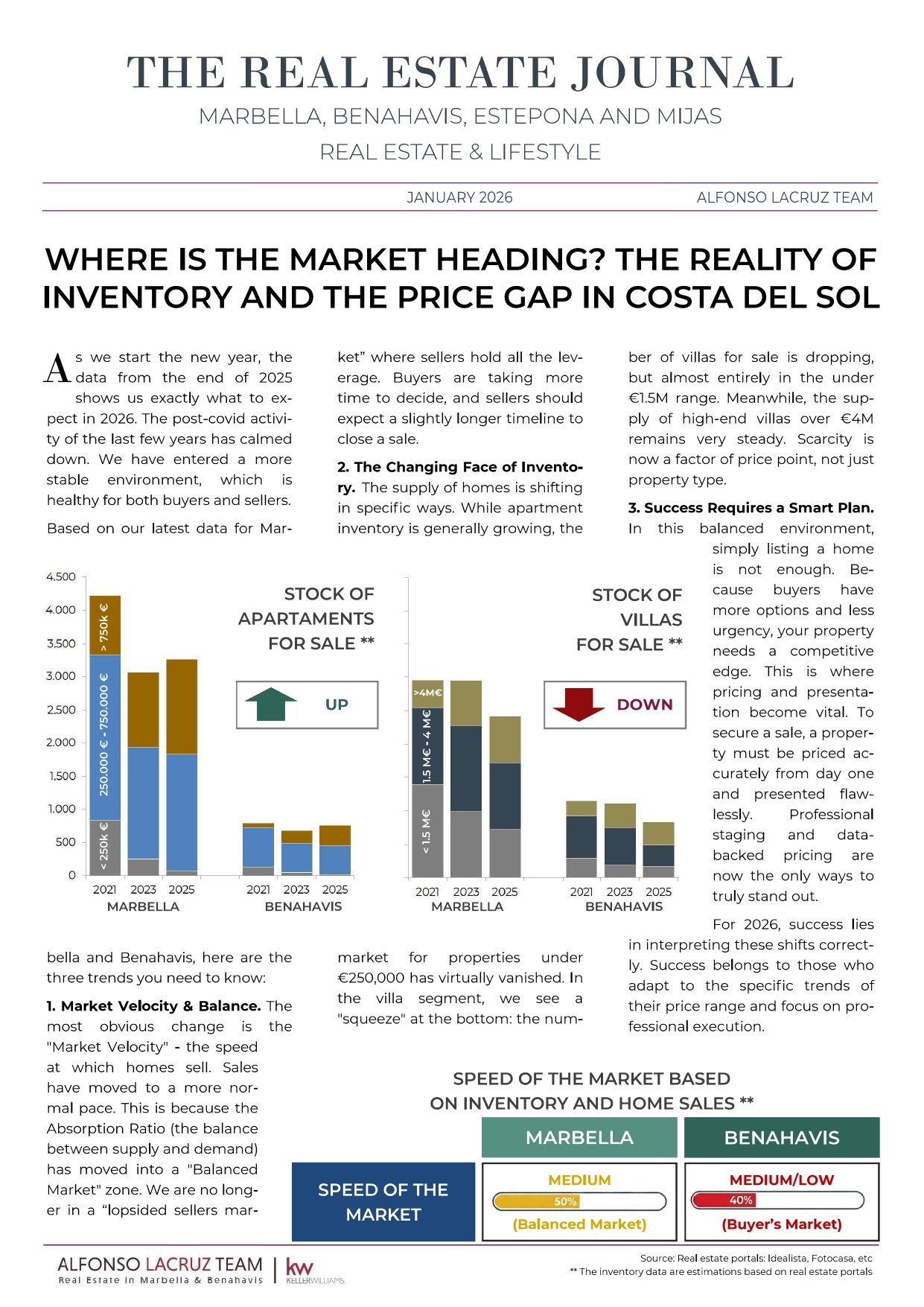

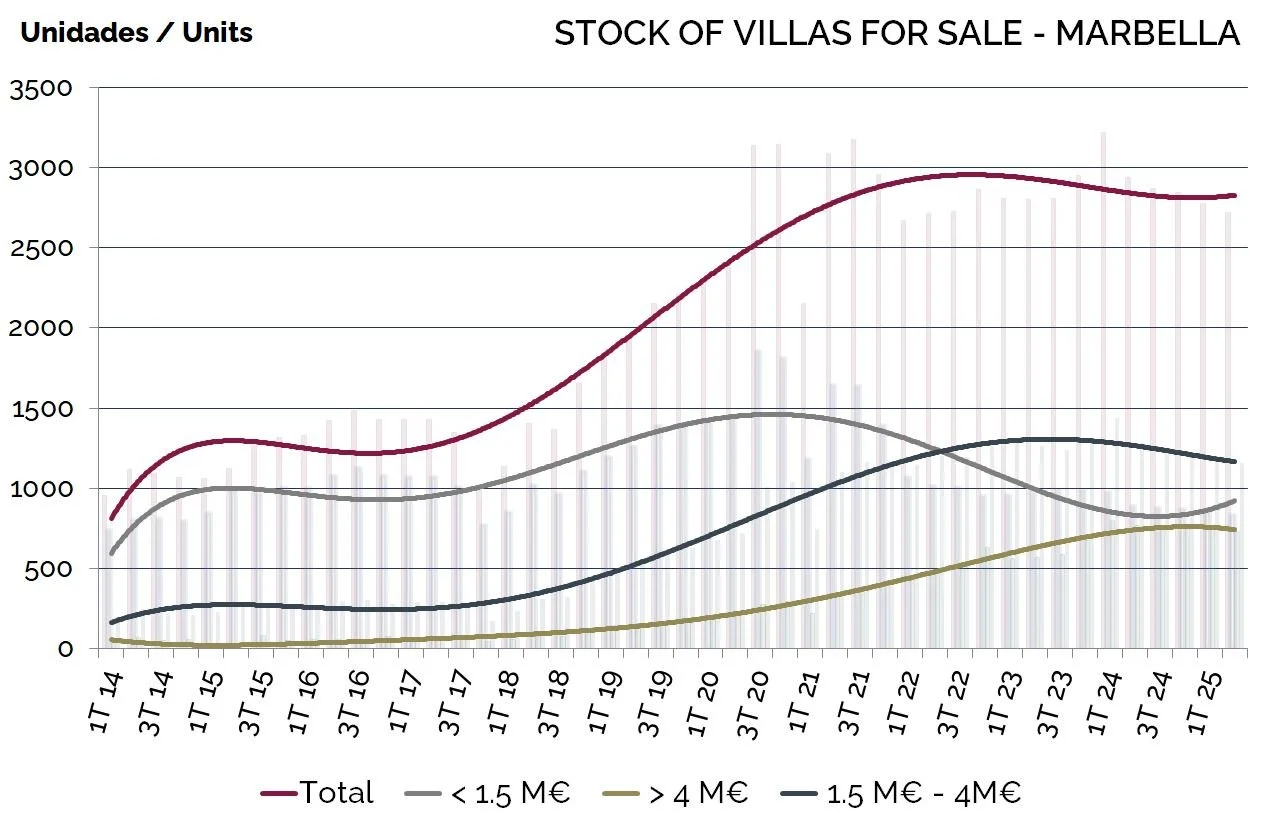

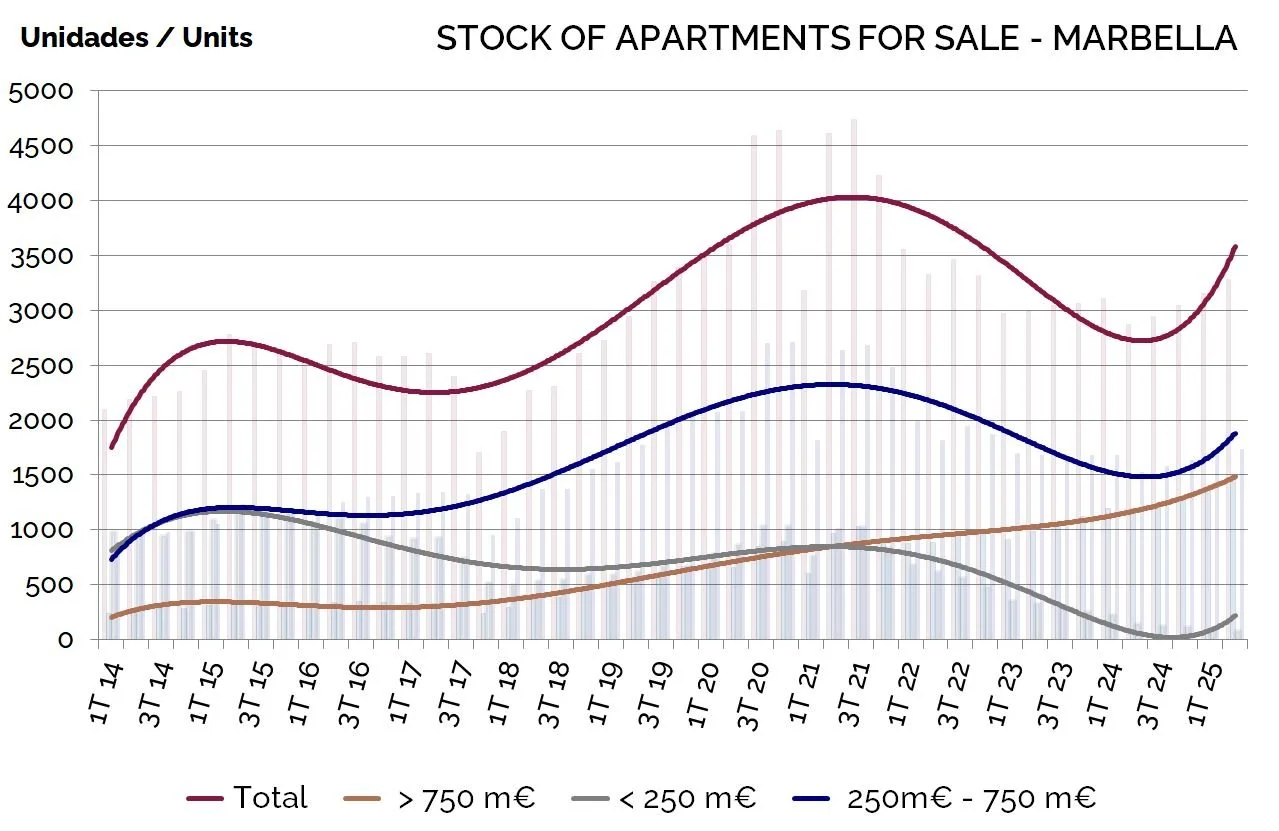

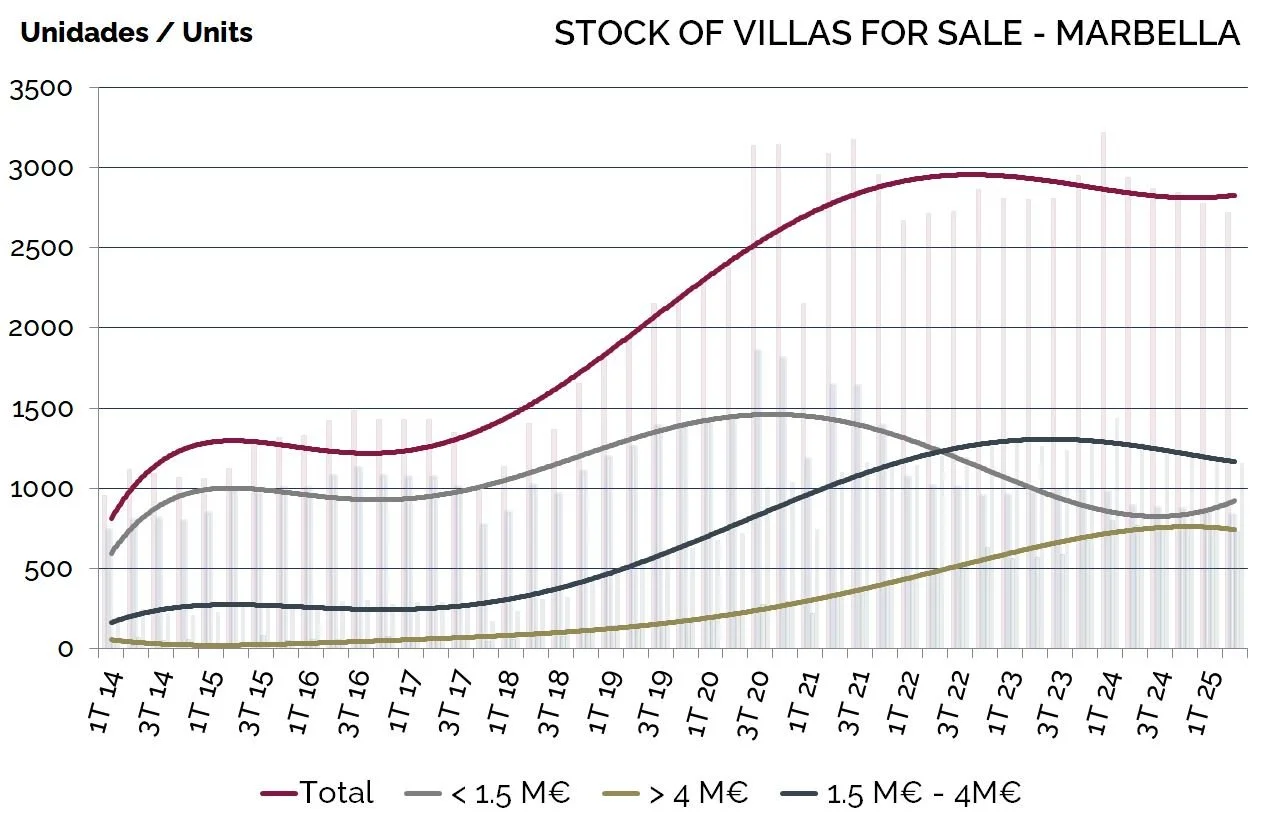

STOCK DE VIVIENDA EN MARBELLA & BENAHAVIS: DOS TENDENCIAS OPUESTAS

Al comenzar el último trimestre del año, el mercado inmobiliario de Marbella refleja dos realidades opuestas: escasez en villas y mayor oferta en apartamentos. Benahavís presenta un comportamiento similar, aunque Marbella muestra la visión más clara del conjunto.

1. Villas: Escasez de Oferta.

El inventario de villas ha bajado un –7,4% interanual, confirmando la limitada disponibilidad. La mayor caída se da en el rango de 1,5–4M€, en descenso desde 2022.

Por encima de 4M€, la oferta se mantiene estable, mientras que las villas más baratas, por debajo de 1,5M€, han bajado debido a la fuerte demanda y la falta de nuevas construcciones.

2. Apartamentos: Aumento del Inventario.

En contraste, los apartamentos han aumentado un +14,5% respecto al año pasado. El mayor crecimiento corresponde al rango 250–750K, que sigue siendo el más activo para compradores nacionales e internacionales. También destaca la gama alta, a partir de 750K, impulsada por proyectos modernos y compras asociadas al estilo de vida. En el nivel bajo, por debajo de 250K, la oferta sigue a la baja, confirmando la falta de opciones asequibles.

3. Polarización. El mercado se polariza

Villas cada vez más limitadas frente a un parque de apartamentos en expansión. La demanda sigue firme,

adaptándose a la oferta disponible en cada segmento.

Para propietarios, significa:

Villas: se benefician de la menor competencia, sobre todo en el rango 1,5M€–4M€.

Apartamentos: más competencia, pero las viviendas bien presentadas y con precio correcto siguen atrayendo compradores.

Compradores: las oportunidades en rangos bajos desaparecen, mientras aumenta la oferta en segmentos medios y altos.

Articulo de

Alfonso Lacruz

MARBELLA & BENAHAVIS MARKET INSIGHT: SUPPLY GAPS ACROSS PRICE RANGES

As we head into the last quarter of the year, Marbella’s real estate market reveals two contrasting stories: villas remain scarce, while apartments show increasing availability. Benahavís follows a similar trend, but Marbella offers the clearest picture.

1. Villas: Declining Supply

Villa stock is down –7.4% year over year, reinforcing scarcity in the detached home segment. The steepest drop is in the 1.5–4M€ range, where supply has tightened since 2022. At the very top, above 4M€, inventory has stabilized, while entry-level villas under 1.5M€ are now limited due to strong demand and minimal new builds.

2. Apartments: Rising Inventory.

In contrast, apartment stock has risen +14.5% compared with last year. Growth is strongest in the 250–750K€ segment, which remains highly active among both national and international buyers. High-end apartments above 750K€ are also expanding, supported by lifestyle demand and modern developments. At the same time, affordable options under 250K€ continue to shrink, reflecting how rare budget-friendly properties have become.

3. Diverging Dynamics.

The overall picture is one of polarization: scarcity in villas versus growing availability in apartments. Rather than a slowdown, demand is adjusting to value and supply across different price brackets.

For homeowners, this means:

· Villa sellers continue to benefit from limited competition, especially if positioned in the 1.5M€–4M€ range.

· Apartment owners will face more competition, but correctly priced and well-presented properties still attract significant buyer interest.

· Buyers should be aware that opportunities in the lower brackets are disappearing, while choice is increasing in mid-to-high-end apartments

ARTICLE BY ALFONSO LACRUZ