Purchasing a luxury villa in Benahavís is not just a real estate decision - it's about entering a lifestyle defined by privacy, security, and comfort. However, the true cost of ownership goes well beyond the listing price.

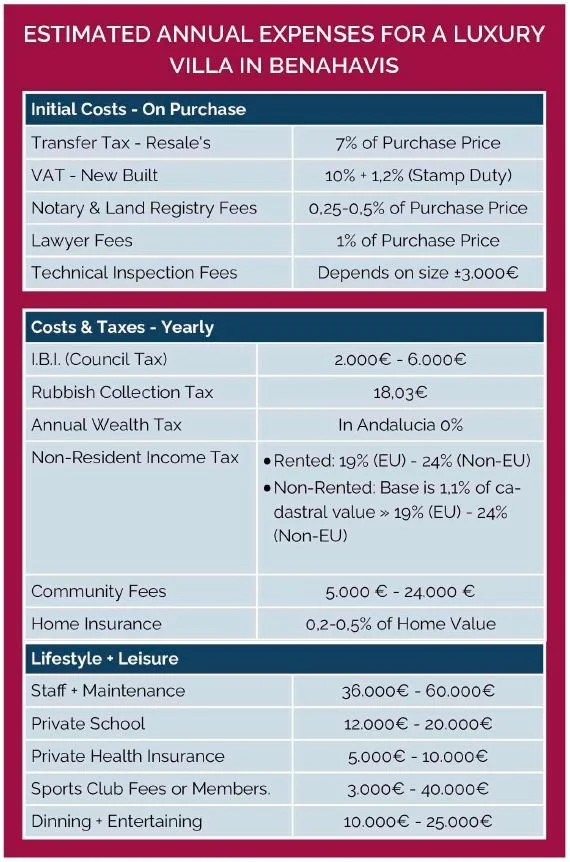

1. Initial Costs - On Purchase: In addition to the property price, buyers must factor in taxes (Transfer Tax for resales. or VAT and Stamp Duty for new builds). Notary and Land Registry fees, legal services and technical inspections. These costs typically range between 10- 12% of the purchase price. Keep in mind that rates may vary depending on the municipality and type of property.

2. Annual Costs & Property Taxes: Once the property is yours. ongoing expenses such as council tax (IBI), rubbish collection, community fees and home insurance become part of your annual budget. For nonresidents. income tax and wealth tax obligations may also apply, especially for properties not used as a primary residence.

"The true cost of ownership is more than square meters - it's how you live within them."

3. Lifestyle & Leisure: Families relocating full - or part-time to Benahavís should also plan for international school tuition, private health insurance, golf or sports club memberships, and regular dining or entertaining. These expenses enhance quality of life - but should be budgeted realistically from the start.

Note: The costs shown in the table are estimates for guidance only. Figures vary depending on lifestyle, residence status, property type and community services such as security or amenities. Taxes must be calculated individually.

For a tailored breakdown. contact our team to help you plan wisely and invest with confidence.